Handpicked updates about India’s business and the business of India

Good morning! Pakistan’s Defence Minister Khawaja Asif may have just invented the world’s first “DIY flood kit”: scoop up the water, pack it in containers, and voilà—problem solved. Forget about homes underwater or fields washed away; apparently, all you need is a few buckets and toxic optimism. Calling the deluge a “blessing,” he urged citizens to store the water like it’s Rooh Afza concentrate for the apocalypse. Relief camps? That’s old school. This disaster management is purely BYOB (Bring Your Own Bucket).

Now, let’s get into the Dispatch! 🚀

Today’s reading time is 7 mins.

Markets 🔔🐂🐻

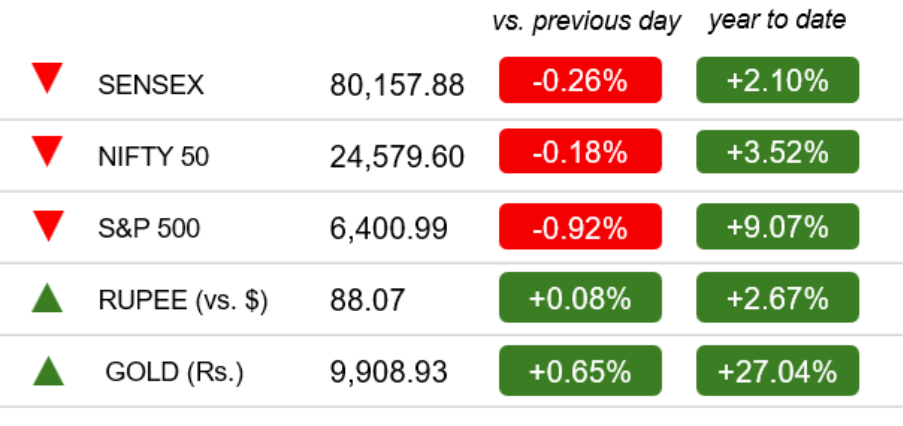

As of the Indian market closed on Sept 2nd

The Indian market experienced a decline on Tuesday due to profit booking in the final hour of trading, weak global cues, and ongoing concerns over US tariffs.

Business & Economy

India’s Online Gaming Ban Triggers Mass Layoffs

Image Credits: Mondo

Real-money gaming (RMG) apps are struggling after the Promotion and Regulation of Online Gaming Bill, 2025, was introduced on August 20 and swiftly passed into law. Daily downloads for popular apps like Zupee, Winzo, Mobile Premier League (MPL), and PokerBaazi have dropped sharply by 60%–95%. Between August 20 and 30, Winzo’s downloads fell nearly 70% to 45,900 per day, while Zupee’s installs plummeted to just 3,490, a 95% decrease. MPL’s rummy and fantasy titles saw a 73% drop to 367 daily installs. In contrast, Dream11 rebounded after an initial dip, reaching 48,500 daily downloads—almost double its previous average. The new law enforces a blanket ban on all real-money online games, including fantasy sports, forcing operators to pivot to free-to-play formats or seek opportunities abroad.

Legal Battle Brews: Head Digital Works (A23) is the first operator to challenge the law in the Karnataka High Court, while other companies remain undecided about pursuing legal action.

Layoffs Sweep Industry: The ban has triggered widespread layoffs. MPL announced plans to cut 60% of its India workforce—300 out of 500 employees—and will focus on overseas markets and free-to-play models domestically. Games24x7 and Baazi Games are halving staff, while Zupee and Probo have discontinued their RMG offerings. Industry insiders warn that more layoffs are likely as companies struggle to sustain costs without monetisation.

What Lies Ahead: The government remains firm, citing addiction, social harm, and financial losses as reasons for the ban. With India now off-limits for real-money gaming, the industry faces an uncertain future, hinging on global expansion, innovation in free-to-play formats, and survival in an unforgiving regulatory climate.

Business India: Dhanda Hai Yeh!

Image Credits: Mint

Tesla’s Indian speedbump: Tesla's much-hyped entry into India seems to be stuck in first gear. Since mid-July, the company has managed just over 600 bookings, with plans to ship only 350 to 500 cars this year to Mumbai, Delhi, Pune, and Gurugram. Steep import duties push the Model Y’s price above ₹60 lakh—almost triple the average Indian EV price—shrinking Tesla’s addressable market, where EVs make up just 5% of sales. Meanwhile, competitor BYD is gaining traction, selling about 1,200 Sealion 7 units in the first half of 2025. Rising U.S.–India trade tensions are dimming any hopes for tariff relief.

IPO frenzy hits the market: SEBI has greenlit a record 13 IPOs in a single week, signalling a listings rush across various sectors from tech to infrastructure. Notable companies include Urban Company, aiming to raise ₹1,900 crore, and boAt's parent company, Imagine Marketing, with a plan for a ₹2,000 crore public issue. Other approvals include Juniper Green Energy's ₹3,000 crore target and Ravi Infrabuild's ₹1,100 crore plan indicating robust and diverse activity in the Indian primary market and reflecting strong investor confidence and business growth.

China’s shift, Reliance’s lift: According to Morgan Stanley, Reliance Industries stands to gain from China's "anti-involution" push to curb overcapacity, particularly in energy and solar supply chains. Combined with Reliance's own restructuring, this could slash energy costs by up to 40% by 2030, with new energy sources contributing approximately 13% to earnings by 2027. The brokerage estimates a $20 billion bump to Reliance’s net asset value and a 17% lift in FY28 earnings, maintaining an “Overweight” rating. Nuvama is bullish too.

Deutsche Bank packs up: Deutsche Bank has reportedly put its India retail banking business up for sale, having invited non-binding bids by August 29. The move is part of a global profitability push, including branch closures and cutting around 2,000 retail jobs in 2025. The sale covers all 17 branches and echoes similar exits by foreign banks like Citi, which sold its India retail unit in 2022.

New routes, new risk: India is diversifying its pharmaceutical export markets to reduce dependence on the United States, its largest market, amid tariff concerns. India and the UAE are reviewing their Comprehensive Economic Partnership Agreement (CEPA) and have committed to facilitating pharma and healthcare trade. Simultaneously, India is targeting markets like Russia, Brazil, and the Netherlands to grow exports, diversifying away from the U.S., which currently accounts for over a third of shipments.

Tech & Business

LinkedIn’s TikTok Glow-Up

Image Credits: LinkedIn

LinkedIn New Avatar: LinkedIn is moving beyond its reputation as a résumé platform and embracing the creator economy. The Microsoft-owned platform now features short video shows, backed by sponsors like IBM and AT&T, aiming to capture the short-form content trend popular on other social networks… think TED Talks meets TikTok, covering themes like entrepreneurship, AI, and the future of work. The video ad program, called BrandLink, has tripled payouts to publishers and creators in the past year, with major media heavyweights such as The Economist, Bloomberg, BBC Studios, Vox Media, and The Wall Street Journal already participating.

Why the Pivot to Video? Video is now one of LinkedIn’s fastest-growing formats, with uploads up 20% this year and its creator base doubling since 2021. The idea is simple: keep users scrolling on LinkedIn the way they would on Instagram or YouTube. For advertisers targeting CEOs, venture capitalists, and other decision-makers, that means more eyeballs and more engagement. LinkedIn is now also scouting lifestyle influencers to broaden its reach.

LinkedIn’s India Market: India is a key growth market for LinkedIn, with 150 million registered members as of early 2025—equivalent to about 10% of India’s total population. For adults aged 18 and above, LinkedIn’s reach climbs to 14.6%, and among internet users, penetration stands at 18.6%. The user base skews heavily male, with 69.8% men vs. 30.2% women, according to LinkedIn’s ad tools.

The Growth Curve: LinkedIn’s ad audience in India grew by 30 million (+25%) between early 2024 and early 2025. Quarter-on-quarter, that’s a rise of 10 million (+7.1%) between October 2024 and January 2025.

Caveat: LinkedIn’s reported figures reflect total registered members, not monthly active users, so these numbers don’t necessarily reflect how many people are logging in and engaging regularly.

World 🌏

Elliott’s $4B PepsiCo Power Play

Image credits: Brand Equity

The New Bid: Elliott Investment Management has snapped up a $4 billion stake in PepsiCo, becoming one of the company’s top five active shareholders. Known for pushing corporate giants to transform, Elliott is expected to demand moves to revive PepsiCo’s share price, which has dropped over 25% from its May 2023 high of $270 billion to about $200 billion today.

Pressure Mounts, Cola Slips: Once a fierce rival to Coca-Cola, PepsiCo’s flagship cola has slipped to fourth place in U.S. sales, trailing Coke, Dr Pepper, and Sprite. Analysts point to tariffs, changing consumer tastes, and aggressive competitors as key headwinds. Meanwhile, PepsiCo’s North America food unit - home to Lay’s, Doritos, and Quaker - has seen slowing growth every quarter since late 2022. Wells Fargo analysts have suggested a “major rethink” of the food division’s cost structure, estimating potential savings of $800 million.

Elliott’s Activist Playbook: Managing over $76 billion, Elliott has a track record for shaking up blue-chip firms, and its PepsiCo stake is among its largest ever, signalling that the firm may push for significant restructuring or strategic shifts. Here’s a look at Elliott’s most high-profile activist campaigns:

AT&T (2019) : marked Elliott’s $3.2 billion stake and push for divestitures and operational changes and secure commitments from AT&T to improve margins, split CEO and chair roles, and halt major acquisitions.

Twitter (2020) : Elliott, with a roughly $1 billion stake, secured board representation in a deal with Silver Lake, while Jack Dorsey remained CEO.

SoftBank (2024) : Elliott rebuilt a stake worth over $2 billion and called for a $15 billion share buyback to boost valuation.

GlaxoSmithKline (2021) : Elliott demanded a board overhaul and management changes at GSK ahead of its consumer health spinoff.

Pinterest (2022) : Elliott won a board seat at Pinterest, signalling its intent to influence strategy.

Starbucks (2022–23) : Starbucks appointed Brian Niccol as CEO under pressure from activists including Elliott.

Salesforce (2023) : Salesforce shares jumped following Elliott’s multimillion-dollar stake announcement even as Elliott nominated board candidates and later withdrew them after Salesforce delivered improved results.

DuniyaDIARY 🌏📒

Image Credits: Bloomberg

Russia-China gas deal: Russia and China signed a binding agreement to build the long-delayed Power of Siberia 2 gas pipeline, strengthening energy ties as Moscow faces Western sanctions. The pipeline will deliver 50 BCM of gas annually from West Siberia to northern China via Mongolia for 30 years.

Nestlé shake-up: Nestlé abruptly dismissed its CEO Laurent Freixe following an internal investigation that concluded he engaged in an undisclosed romantic relationship with a direct subordinate, violating the company’s code of business conduct.

Kraft Heinz split: Nearly a decade after their blockbuster merger, Kraft Heinz will split into two companies by late 2026. Years of weak sales and shifting consumer tastes toward healthier options drove the move. Despite selling brands like Planters and natural cheese, the company’s net sales still dropped 3% in 2024.

National housing emergency: The Trump administration is exploring emergency measures to tackle soaring housing costs, with Treasury Secretary Scott Bessent warning of a potential declaration of a national housing emergency this fall.

VW’s New Idea: Volkswagen’s works council chair, Daniela Cavallo, has urged CEO Oliver Blume to relinquish one of his two leadership roles - overseeing both Volkswagen and Porsche. In an internal memo shared during a staff meeting, Cavallo warned that Blume cannot effectively serve as a “part-time boss” at VW while continuing to run Porsche, especially after Porsche's 2022 spin-off. Corporate governance concerns are rising, and Porsche is reportedly seeking a successor.

Gold Soars: Gold climbed to a historic high, surpassing $3,500 an ounce, as markets ramped up expectations of imminent U.S. Federal Reserve interest rate cuts. This rally was fueled by growing concerns over the Fed’s independence, a weakening dollar, robust investor and central bank demand, and geopolitical uncertainty.

Aur Batao 📰

BCCI seeks sponsor: After Dream11's exit, the BCCI is seeking a new lead sponsor for the Indian cricket team after the recent ban on online gaming apps. To be eligible, they need a net worth or average turnover of at least ₹300 crore over the past three years.

TCS wage hike: Tata Consultancy Services has finally rolled out its annual wage hikes after a five-month delay, with an average increase of 4.5% to 7% for most employees. This is the lowest increase in four years, reflecting a slow IT business environment.

BigBasket’s leadership: BigBasket's CEO Hari Menon is set to transition from his role, with Tata Group seeking new leadership to bolster the company's quick commerce strategy against rivals. The move follows a 3% drop in BigBasket's B2C revenue in fiscal year 2025.

India's space chip: ISRO and SCL have unveiled the Vikram 32-bit processor, India's first indigenous space-grade chip. Fabricated with 180-nanometre CMOS technology, it's a major upgrade and has been successfully tested on the PSLV-C60 mission.

Delhi flood alert: Delhi is on flood alert as the Yamuna river has crossed the danger mark of 205.33 meters, reaching 205.75 meters. Due to heavy rains and water discharges, authorities have advised residents of low-lying areas to evacuate, and the Old Railway Bridge has been closed to traffic.