Handpicked updates about India’s business and the business of India

The Canadian Dream (if there ever was one) is dying a rather rapid death for Indian students. Canada has drastically tightened its student visa rules, sending the rejection rate for Indian applicants soaring to 74%. Guess the years of funnelling Indian student tuition to non-functioning healthcare might just be over. Maybe try getting into IIT instead, should be roughly the same odds (jk, it’s actually much lower, we checked).

Now, let’s get into the Dispatch! 🚀

Today’s reading time is 5.5 mins.

Markets 🔔🐂🐻

As of the Indian market closed on Nov 3rd

The stock market snapped a two-day losing streak on Monday, ending a volatile session higher. The Sensex and Nifty closed in the green, driven by continued upward momentum, particularly in realty and state-owned bank stocks.

Business & Technology

The Real Game Behind Reliance, Airtel’s ‘Free Brains’

Image credits: Times Now

When something comes free in the digital world, it usually means you are the product. And now, India’s telecom giants - Reliance Jio and Bharti Airtel - are handing out artificial intelligence ‘brains’ for free. The question is, why?

The Great AI Giveaway: Reliance Jio recently tied up with Google to offer a year of free Gemini Advanced (Google’s AI assistant) to users on its Unlimited 5G plan. Not to be left behind, Airtel partnered with AI search startup Perplexity, giving its subscribers an 12-month free Pro plan. On paper, it sounds like a sweet deal -premium AI tools, no cost. But behind the generosity lies a much bigger strategy. Both telcos are racing to stay relevant as data tariffs flatten and subscriber growth slows. With over 900 million mobile users, India is the world’s biggest connected playground. Giving away AI isn’t charity, it’s acquisition 2.0.

The Perfect AI Test Lab: For global tech companies, India is the golden goose, diverse languages, billions of data points, and millions of daily interactions. Training AI models on this scale provides unmatched localisation and depth. Think of it as a free, real-world AI laboratory that doubles up as a massive user base. For telecom companies, partnering with these AI firms helps them evolve beyond being just data pipes. They get to own the “access layer” (the interface between the user and AI) before big tech does.

The Hidden Stakes: But make no mistake: there’s nothing truly “free” about free AI. Behind every chatbot conversation lies a data trail, and whoever controls that trail controls the future of monetisation. If telcos succeed, they could redefine their business from selling GBs of data to selling intelligence and services. If not, they’ll just become the middlemen while global AI firms walk away with the real prize - India’s digital data.

Business & Markets

Lenskart’s Dazzling IPO Raises An Old Question: Are Indian Startups Still Overpriced?

Image credits: Moneycontrol

Lenskart’s blockbuster IPO may have been sold out in under five hours, but it’s also reignited a debate that refuses to die - are Indian startups being valued on hype rather than hard numbers?

A Price That Turned Heads: The eyewear retailer’s ₹7,278-crore (US $821 million) public issue was a mix of fresh shares and an offer for sale. Priced between ₹382 and ₹402 per share, the IPO pegs Lenskart’s valuation at around US $8 billion. That’s a hefty tag even for India’s largest organised eyewear brand and analysts aren’t sure it’s justified. Market experts say Lenskart “offers scale, but not necessarily value.” Its rapid expansion and omnichannel strategy are impressive, but the profitability picture remains fuzzy. When compared with global peers like EssilorLuxottica, which trades at roughly 45 times forward earnings, Lenskart’s multiples appear steep, perhaps too steep for comfort.

A Familiar Pattern: This isn’t the first time India’s IPO market has been swept up by startup euphoria. Since 2021, around 32 startups have gone public and nearly half now trade below their issue price. From Paytm to Mamaearth, investors have learnt that big buzz doesn’t always mean big returns.

Why The Concern Runs Deeper: The rush to list at lofty valuations may be tempting for startups, but it risks eroding investor confidence. Mutual funds and retail investors, already wary of post-listing dips, are now treading cautiously. The big question isn’t whether India’s startups can grow, it’s whether they can grow profitably. The Lenskart IPO highlights that tension perfectly.

Business India: Dhanda Hai Yeh!

Image credits: Hindu Business Line

SC Lets Vodafone Idea Reassess AGR Dues; Stock Jumps 10%: Vodafone Idea has received major relief after the Supreme Court allowed a full reassessment of its adjusted gross revenue (AGR) dues up to FY17. The move could significantly reduce its massive liabilities, giving the debt-laden telecom operator crucial breathing space. Following the verdict, Vodafone Idea’s shares jumped nearly 10% on hopes of financial stability.

Airtel Profit Surges 89% In Q2: Bharti Airtel reported a stellar 89% year-on-year surge in consolidated profit to ₹6,792 crore for Q2FY25, driven by strong data and 4G subscriber growth. Revenue climbed 26% to ₹39,110 crore, while average revenue per user (ARPU) hit ₹256, reflecting improved customer mix.

Pine Labs Eyes $2.9B IPO at Half Its Last Valuation: Fintech firm Pine Labs plans to go public at a valuation of around $2.9 billion, almost half of its previous private market value. The move reflects a sobering trend among Indian startups recalibrating expectations amid tighter global liquidity. Despite the markdown, Pine Labs remains one of India’s leading merchant payment solutions providers. Market watchers view this as a test case for realistic pricing in upcoming fintech IPOs.

India’s Bioeconomy To Hit $300B By 2030: India’s bioeconomy is set for massive growth, with NITI Aayog projecting it to hit $300 billion by 2030, up from $137 billion in 2022. The report spotlights expanding opportunities in biotechnology, biofuels, and sustainable agriculture as key drivers.

India, Bahrain Open Talks On Trade Pact: India and Bahrain have begun negotiations for a comprehensive economic partnership agreement aimed at boosting trade, investment, and digital collaboration. The proposed deal could enhance India’s outreach in the Gulf region and deepen cooperation in energy, infrastructure, and fintech. Officials say the pact aligns with India’s broader strategy to diversify trade partners amid shifting global supply chains.

World 🌏

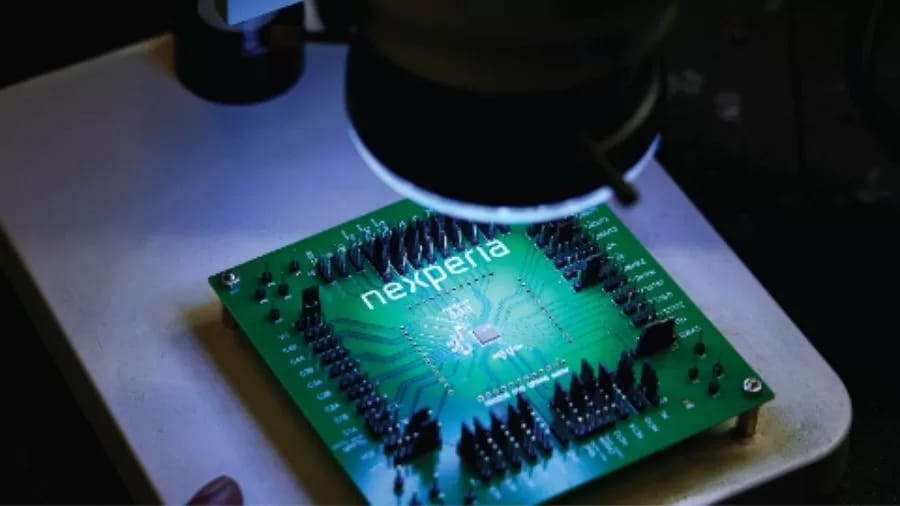

Inside The Nexperia Auto Crisis Rocking Global Carmakers

Image credits: Global Brands Magazine

A Small Chip, A Big Crisis: It began with a single government move that sent shockwaves through the global auto industry. The Dutch government placed Chinese-owned Nexperia, a leading maker of mature-node automotive chips, under state control citing national security concerns. In response, China restricted exports, creating a supply shock that rippled from Europe to Japan. What might have seemed like a minor trade spat quickly morphed into a full-blown manufacturing crisis, exposing how deeply dependent modern vehicles are on small, inexpensive chips that quietly power everything from airbags to mirrors.

Why Nexperia Matters So Much: Unlike high-end processors used in AI or smartphones, Nexperia’s chips are the “invisible essentials” of the auto world - low-cost, mass-produced semiconductors used across braking systems, power steering, and safety sensors. With over 10% of global auto-grade chip supply linked to Nexperia, its sudden disruption left automakers scrambling. Switching suppliers isn’t simple; these chips undergo months of validation and safety certification, making quick replacements nearly impossible. What’s unfolding is a harsh reminder of how fragile even the most stable supply chains can be.

Automakers In ‘War Room’ Mode: As the crisis deepened, carmakers like Volkswagen, Honda, and Stellantis activated “war rooms” command centers where executives monitor chip inventories, reroute shipments, and adjust production lines daily. Stellantis’ CEO described it as a “live battlefield,” with engineers redesigning modules to fit alternate semiconductors and procurement teams racing to secure whatever stock remains. It’s a déjà vu moment for the industry still haunted by the 2021 chip shortage, only this time, the problem isn’t demand but geopolitics.

DuniyaDIARY 🌏📒

Image credits: Reuters

US Tariffs Hit Global Factories: Factory output across Asia is weakening as new US tariffs begin denting global trade flows. From China and South Korea to Taiwan and Japan, export orders have fallen, particularly in electronics and machinery. Economists warn that the slowdown could spill over into early 2026, stalling Asia’s fragile post-pandemic recovery.

Strong Quake Devastates Afghanistan: A magnitude 6.3 earthquake struck near Mazar‑e Sharif in northern Afghanistan at a depth of 28 km, leaving at least 20 people dead and more than 300 injured. Rescue teams raced to remote villages across Balkh Province and Samangan Province amid damage to historic buildings including the 15th-century Blue Mosque.

Trump Draws Line On Nvidia Chip Sales: US President Donald Trump said he would block China and other nations from accessing Nvidia’s Blackwell AI chips, calling them a matter of national security. The remarks come as Washington already tightens export controls on advanced semiconductors. The statement rattled tech investors and reignited debate over the global AI supply chain’s political vulnerability.

Turkey Turns To Non-Russian Crude: Turkey is increasing imports of non-Russian crude, turning to suppliers in Iraq, Kazakhstan, and the U.S., as fresh Western sanctions tighten restrictions on Moscow’s exports. Traders say refiners are diversifying fast to avoid financial complications from sanction-linked payments. The move marks a quiet but significant shift in Turkey’s energy mix.

$9.7 Billion AI Cloud Pact For Microsoft: Microsoft has signed a $9.7 billion partnership with Australian data center operator IREN to expand its AI cloud infrastructure. The long-term deal includes developing energy-efficient data centers powered by renewable sources. It’s one of Microsoft’s largest cloud investments outside the U.S., reinforcing its aggressive push into AI computing.

Aur Batao 📰

Rajan says India’s Real Worry Isn’t Trump’s H-1B Fee: Former RBI Governor Raghuram Rajan said India shouldn’t panic over Donald Trump’s proposed $100,000 H-1B visa fee, arguing that the larger concern lies in India’s weak job creation and talent retention. Rajan stressed that focusing on strengthening domestic opportunities and innovation ecosystems will matter more than external visa barriers.

ED Seizes ₹3,000 Cr Anil Ambani Assets: The Enforcement Directorate has attached 40 properties worth ₹3,000 crore linked to Anil Ambani’s Reliance Group across Delhi, Mumbai, and Chennai. The action is tied to a money-laundering probe connected with alleged loan defaults and fraud. This marks another major blow to the troubled Reliance ADA Group, already facing multiple debt investigations.

India Hit Harder by U.S. Tariffs Than China: India has unexpectedly found itself facing higher average U.S. tariffs than China under Donald Trump’s renewed trade policy. Analysts say this move challenges India’s export competitiveness, especially in sectors like steel and electronics. It also raises doubts about Trump’s promise of a “fair” trade framework for allies.

Mumbai’s Si Nonna’s Wins Italy’s Top Pizza Honour: Mumbai’s Si Nonna’s has earned Italy’s prestigious AVPN certification, a global standard for authentic Neapolitan pizza. The recognition places the pizzeria among an elite circle that meets Italy’s strict quality benchmarks. The award shows India’s growing appreciation for artisanal cuisine and international culinary excellence.