Handpicked updates about India’s business and the business of India

In really sad and unfortunate news - an IAF HAL Tejas aircraft (used in combat) nosedived during a Dubai Air Show and crashed, killing the pilot. A court of inquiry has been set up to ascertain the cause of the accident. There were allegations of a Tejas aircraft experiencing an oil leak while on display at the air show on Thursday, but these were refuted by Press Information Bureau. We don’t know if this was the same crashed aircraft.

Now, let’s get into the Dispatch! 🚀

Today’s reading time is 6 mins.

Markets 🔔🐂🐻

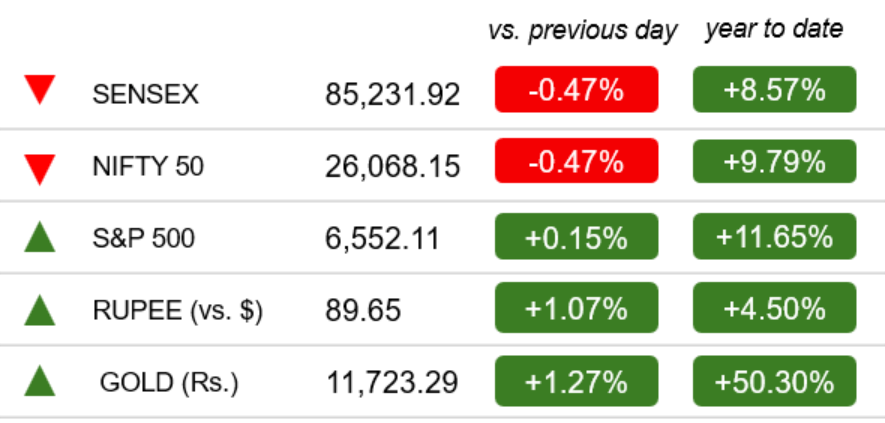

As of the Indian market closed on Nov 21st

Indian stock market closed 0.5% lower on Friday, snapping its two-day winning streak amid weak global cues. Sharp declines led the downturn in key finance heavyweights like HDFC Bank and ICICI Bank.

Business & Economy

HDFC Bank’s Rise, The Journey

Image credits: Mint

From Housing Dreams To Banking Dominance: HDFC’s rise to becoming India’s most valued brand didn’t begin with a bank, it began with a housing crisis. In 1977, when home loans were nearly impossible to secure, HDFC Ltd stepped in with a structured, disciplined lending model that helped millions of middle-class Indians buy their first homes. That early trust and credibility would later become the foundation of its banking empire.

The Birth Of HDFC Bank: India’s economic liberalisation in the early 1990s opened the doors for private banks. HDFC seized the opportunity, receiving RBI approval in 1994 and launching HDFC Bank in 1995 under the leadership of Deepak Parekh and the bank’s first MD, Aditya Puri. Their philosophy was clear: grow cautiously, stay technologically ahead, and keep the balance sheet clean.

That Strategy Built A Powerhouse: HDFC Bank invested heavily in technology long before “digital banking” became a buzzword. Its focus on retail banking, credit cards, SME lending, and payments helped it scale steadily without compromising on risk discipline. Whether through banking correspondents for underserved regions, e-Mitra kiosks, or innovations like Xpress Car Loans, HDFC Bank differentiated itself by solving real customer problems. Initiatives like “Vigil Aunty” also strengthened its brand identity, making security and trust easy to understand for millions of users.

The 2023 Merger: The merger of HDFC Ltd with HDFC Bank in 2023 created a financial giant unmatched in size and scope. It combined the country’s largest housing finance lender with its most efficient private-sector bank, giving the institution unparalleled distribution, low-cost deposits, and a full-stack financial services portfolio. This consolidation wasn’t just operational, it symbolised the union of two of India’s strongest trust-driven brands.

Becoming India’s Most Valued Brand: According to the 2025 Kantar BrandZ report, HDFC Bank is now India’s most valued brand, with an 18% jump in brand value to around $45 billion, overtaking even TCS. Its position is built not on aggressive marketing, but on decades of consistency, credibility, and meaningful innovation.

Food & Drug Regulations

Why India Is Pulling ‘ORS’ Drinks Off The Shelves

Image credits: Deccan Herald

A Crackdown On Misleading Labels: India’s food safety regulator, FSSAI, has launched a nationwide crackdown on drinks that misleadingly use the term “ORS” on their labels. Over the past few years, dozens of fruit-based beverages, electrolyte drinks and ready-to-drink products have casually slapped on the three-letter tag, hoping to borrow credibility from a medically essential formulation. But the regulator has now made it clear: unless a product meets the exact composition of a real Oral Rehydration Solution, it cannot use the ORS name, in any form, with any prefix or suffix.

Why The Term ‘ORS’ Is Not Just Branding: Unlike a typical commercial beverage, ORS isn’t a lifestyle drink; it’s a life-saving medical solution. It works only when made in a specific ratio of glucose and electrolytes. Deviate from this formula and the effect can reverse, instead of rehydrating, high-sugar drinks can worsen dehydration, particularly during diarrhoea. Doctors have long warned that many so-called ORS drinks in the market contain far too much sugar and too little sodium and potassium. For children, especially in rural or low-income households, this mix-up isn’t just misleading; it can be dangerous.

What FSSAI Has Ordered: In mid-October, FSSAI issued a directive stating that no food or beverage product may use the word “ORS’’ unless it adheres to the medical formulation set by Indian and global health standards. By late November, the regulator instructed all states and Union territories to remove such products from shelves, including chemist stores, supermarkets, general trade outlets and e-commerce platforms. Importantly, the order does not apply to genuine ORS, which is classified as a drug and sold in sachet form.

Why This Matters For Consumers: The action illustrates a bigger problem: the increasingly blurry line between health branding and real medical efficacy. With wellness drinks crowding the market, consumers often trust labels more than ingredients. The ORS crackdown is a reminder to pause, read carefully and reach for medically approved sachets during dehydration, not colourful bottles promising instant relief.

A Wake-Up Call For The Industry: For beverage makers, this signals a tightening of accountability. Health-coded marketing will now face closer scrutiny, and rightly so. When a product is tied to something as critical as rehydration therapy, accuracy isn’t optional, it’s non-negotiable.

Business India: Dhanda Hai Yeh!

Image credits: Moneycontrol

Adani Green Expands Via New Entities: Adani Green Energy has established two new step-down subsidiaries in Gujarat to strengthen its renewable operations. This move aligns with the company’s strategy to accelerate its green energy footprint and deepen its clean-power business. The newly formed entities will support both solar and wind power development, boosting scale.

Tata Chemicals Invests ₹910 Cr To Expand Plants: Tata Chemicals has approved a ₹910 crore investment to expand its manufacturing capacity at two plants: ₹135 crore for dense soda ash at Mithapur (Gujarat) and ₹775 crore for precipitated silica at Cuddalore (Tamil Nadu). The board greenlit these plans to boost production of its core chemical products. This expansion is part of the company’s broader strategy to scale its industrial footprint. Despite this large capex, the company’s shares dipped slightly on the BSE.

Afghanistan Seeks Indian Investment: Afghanistan is offering Indian investors steep tax breaks, duty-free raw materials, and free land to lure investment into sectors like mining, agriculture, IT, energy, and textiles. Its Commerce Minister, on a visit to New Delhi, indicated inclusive business opportunities and proposed five-year tax exemptions for new industries. The country also plans to restart air cargo services with India, strengthening trade ties. These incentives aim to rebuild Afghanistan’s economy while drawing in foreign capital.

Flipkart Festive Sale Boosts Walmart International: The timing of Flipkart’s “Big Billion Day” sale gave a meaningful lift to Walmart International, which posted 10.8% revenue growth to USD 33.5 billion in Q3 FY26. E-commerce sales within the segment jumped 26% while the advertising business surged 34%, both aided by Flipkart’s event. However, Walmart cautioned that the event’s timing may weigh on Q4 growth.

World 🌏

Eli Lilly Becomes The First Healthcare Company To Touch The $1 Trillion Mark

Image Credits: Business Today

Eli Lilly has entered a league previously reserved for tech titans, briefly crossing the $1 trillion market-cap milestone - a historic first for any company in the global healthcare industry. The achievement underscores not just a booming valuation but a major shift in how the world views the business of health, particularly the fast-expanding market for obesity and diabetes treatments.

The Drugs That Changed Everything: The meteoric rise is fuelled by two breakthrough medicines: Zepbound, an obesity drug, and Mounjaro, a diabetes medication that has turned into one of Lilly’s most successful launches. Demand for both continues to soar as consumers, healthcare providers, and insurers view obesity management as a long-term clinical priority rather than a cosmetic choice. The global market for weight-loss drugs is expected to balloon to nearly $150 billion by the early 2030s, and Lilly is strategically positioned at the centre of this surge. Zepbound is already considered a potential blockbuster, while Mounjaro has exceeded sales expectations across multiple quarters, contributing significantly to Lilly’s top line.

A Pharma Giant That Now Looks Like a Growth Tech Company: Lilly’s ascent marks a transformation in investor perception of pharma companies. Traditionally seen as slow, stable, and heavily regulated, the sector rarely attracted the kind of high-growth valuations enjoyed by Big Tech. But with advances in metabolic science, massive global demand, and real-world clinical outcomes, Lilly now looks less like a legacy drugmaker and more like a high-growth innovator. Its trillion-dollar valuation puts it in the same conversation as Apple, Microsoft, Nvidia, and Saudi Aramco, companies whose market caps reflect scale, innovation, and global influence.

What’s Next For Lilly? If the company continues on its current trajectory, expanding production, growing global access, and broadening research, its rise could redefine the entire pharmaceutical landscape. But the trillion-dollar club demands consistency, clarity, and sustained breakthroughs. Lilly has arrived; the real test begins now.

DuniyaDIARY 🌏📒

Image credits: NPR

UAE-Canada $50 Billion Investment Pact: The United Arab Emirates and Canada have launched a US $50 billion investment framework to deepen cooperation across energy, technology, logistics and strategic sectors. The pact reflects a shared ambition to scale high-value cross-border investments and reinforce long-term economic ties. Government officials say it marks a new chapter in the bilateral relationship, aimed at translating trust and policy alignment into commercial opportunities.

Amazon Axes Thousands Of Engineers Amid Layoffs: Amazon has cut thousands of engineering roles as part of its largest-ever layoff wave, even while the company stresses a need to “innovate much faster than ever before.” State filings show engineers represented nearly 40 % of impacted positions in key U.S. tech hubs. The move shows the tension between scaling innovation and controlling cost during an era of AI-driven transformation.

SoftBank Shares Tumble Over 10% On Chip Sell-Off: SoftBank Group’s share price slid more than 10 % as a broader rout in Asian chip stocks, sparked by dropping Nvidia Corporation shares sent shockwaves through the tech sector. The Japanese conglomerate’s heavy exposure to AI-hardware and chip-maker investments means the crash raises concerns about valuation excess and funding needs in the next phase of its growth.

Japan Rolls Out $135B Stimulus: Japan is launching a US$135 billion stimulus package to bolster its slowing economy and support consumers, according to NHK. The plan includes a mix of cash payments and public investment to revive domestic demand. Officials hope it will cushion the impact of weak exports and low inflation.

U.S. Threatens To Cut Intel Support To Ukraine: The U.S. is threatening to withhold intelligence sharing and weapons from Ukraine in a bid to pressure Kyiv into accepting a peace deal, according to U.S. officials. The move comes amid mounting concerns in Washington over rising costs and limited strategic returns. Ukrainian security officials have publicly denied any agreement to the peace terms.

Trump’s ‘Golden Dome’ Missile Shield Faces Delays: The development of Trump’s proposed “Golden Dome” missile-defense system is being threatened by a series of setbacks, including cost overruns and technical challenges. Sources say key elements of the system are behind schedule, putting its viability in doubt. The timeline for deployment may shift significantly as the Pentagon weighs funding and operational risks.

Nokia To Invest $4B In U.S. AI: Nokia is planning a US$4 billion investment in artificial intelligence operations in the United States, aiming to boost innovation and R&D. The move underscores Nokia’s ambition to expand its presence in AI-driven telecom and technology infrastructure. The funds will reportedly support AI labs, talent acquisition, and collaborations with American tech firms.

Aur Batao 📰

Siddhant Kapoor & Orry Summoned In Drug Probe: Mumbai Police have issued summons to actor Shraddha Kapoor’s brother, Siddhant Kapoor, and actor-entrepreneur Orry for questioning in a ₹252-crore drugs case. The investigation reportedly links both individuals to an alleged narcotics network. Prosecutors are probing the financial and supply chain aspects behind large-scale drug trafficking.

India Reopens Tourist Visas For Chinese Citizens: India has resumed tourist visa issuance for Chinese citizens, ending a five-year freeze that began amid geopolitical tensions. The decision aims to revive people-to-people ties and boost bilateral tourism as part of a broader diplomatic reset. Analysts suggest the move could lay groundwork for softer engagement between the two countries. Visa resumption is also expected to provide an economic boost to India’s tourism and hospitality sectors.

BJP Aims For 103 Seats With NDA In Assam Polls: The BJP, in alliance with its regional partners, has set a bold target of 103 seat wins in Assam’s upcoming assembly election. The announcement marks the party’s aggressive push to consolidate power in the strategically crucial northeastern state. Party leaders claim this goal reflects strong grassroots mobilization and favourable public sentiment ahead of voting. Political analysts see this as a high-stakes gamble that could reshape regional power dynamics.

India Overhauls Labour Laws For Lakhs Of Workers: India has introduced new labour codes ensuring minimum wage guarantees, gratuity, and social security benefits for around 40 crore workers. The reforms, which consolidate multiple labour laws, are designed to formalize protections across informal sectors. Employers will now have stricter obligations related to retirement, sickness, and maternity coverage. The move marks one of the most significant labour reforms in decades, aiming to boost worker dignity and economic security.

France Accuses India Of Blocking COP30 Fossil Fuel Deal: France claims that India, along with Russia and Saudi Arabia, is obstructing a fossil-fuel agreement at COP30 by resisting stricter phase-out commitments. According to French diplomats, India’s stance centres on energy security and economic development concerns. The row underscores geopolitical tensions between major energy-consuming nations and climate policy advocates. Observers warn that without consensus, the summit could struggle to produce a strong agreement.