Handpicked updates about India’s business and the business of India

Indian cinema has lost one of its brightest stars. Dharmendra, our Dharam Paaji, has passed away at 89, leaving behind an era that can never be recreated. From Veeru’s water-tank warning to his effortless charm in Chupke Chupke, he defined what it meant to be a true hero. In one of his most recent reels he left behind a saying for all of us to live by “Badi ka ant hai kahin aas paas, naeki ka koi ant nahi - kitab naeki ki padh le bande, esse bada koi Granth nahi.” An era ends, but Dharmendra’s legend will stay forever.

Now, let’s get into the Dispatch! 🚀

Today’s reading time is 6 mins.

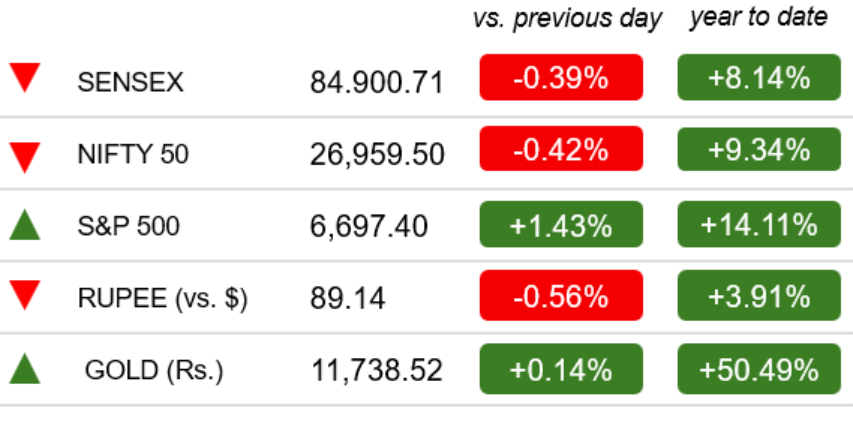

Markets 🔔🐂🐻

As of the Indian market closed on Nov 24th

The Indian stock market fell for a second straight session on Monday due to profit booking amid mixed global cues. The Sensex dropped 331 points, and the Nifty lost 109 points, resulting in an investor loss of ₹7 lakh crore in two sessions.

Business & Economy

India Becomes The New IPO Magnet And Global Companies Are Lining Up

Image credits: Bloomberg

A Market Too Hot To Ignore: India’s IPO market is in one of its strongest phases in years. A mix of record retail participation, aggressive mutual fund inflows, and resilient market confidence has created ideal conditions for companies looking to raise capital. But what makes this moment distinct is that the excitement isn’t limited to homegrown firms. Global multinationals are increasingly exploring the idea of listing their Indian subsidiaries, a trend that could reshape the country’s capital-market landscape.

Why MNCs Suddenly Want To List In India: The appeal is simple: valuation. Indian markets consistently award higher premiums to consumer, auto, and electronics businesses compared with their global peers. For multinational companies, India has become not just a strong operating market but also a lucrative financial market. Add to this the deep domestic liquidity with retail investors pouring in billions each month and listing in India becomes a strategic opportunity to unlock value that parent companies often don’t achieve in their home markets.

Hyundai, LG, & More Could Be The Beginning: Hyundai Motor India’s planned listing has set a template that other MNCs are closely watching. LG Electronics India is also preparing an IPO, signalling confidence in the country’s long-term consumption story. Market analysts believe more global companies with strong India businesses from FMCG to specialty manufacturing, may follow. For many, India is now a bigger growth engine than their home markets, making a local listing not just attractive, but inevitable.

But Not Without Risks: A booming market also brings challenges. With high valuations come questions about sustainability. Overcrowding in the IPO pipeline could lead to pricing pressure, investor fatigue, and a more selective capital-raising environment. MNCs must balance ambition with realistic valuations to avoid the fate of overhyped IPOs that eventually underperform.

A New Chapter For Indian Markets: If this trend continues, India could evolve into a global hub for multinational subsidiary listings, a validation of its economic momentum and market maturity. The next few quarters will decide whether this is a temporary wave or the start of a long-term shift in how global companies unlock value in India.

Economy & Business

Food Prices Fall, Rupee Falls Too, Why India’s Inflation Comfort Is Fragile

Image credits: ICICI Direct

A Rare Moment Of Relief: For the first time in years, India finds itself in a genuine inflation sweet spot. Retail inflation hit an extraordinary low of around 0.25% in October, driven almost entirely by a sharp decline in food prices. Vegetables, cereals, and pulses - the usual culprits behind price spikes - turned deflationary, pulling the overall number down and offering long-awaited breathing room to households and policymakers alike.

Food Prices Calm, But Not The Whole Story: A big chunk of this comfort rests on a favourable base effect, not just real-time price cooling. Food inflation fell more than 5%, but core inflation - which strips out food and fuel - still sits at a steady 4.4%. That means underlying price pressures haven’t vanished; they’re merely overshadowed by the temporary collapse in food costs. The headline number looks pretty, but beneath it, the economy hasn’t fully loosened up.

The Rupee Problem: The bigger test comes from outside. The rupee has been slipping, and a weaker currency directly fuels imported inflation. India is heavily dependent on imports - crude oil, electronics, chemicals - and every notch of rupee depreciation raises the risk of cost-push inflation landing a few months down the line. Add to this a widening trade deficit, and the external-sector math starts looking uncomfortable.

Is A Rate Cut Coming? With inflation so low, the Reserve Bank of India technically has policy room to cut rates, but the central bank is unlikely to rush. The RBI would want clarity on the next GDP print, the rupee trajectory, global energy prices, and whether core inflation softens further. Cutting rates too soon could backfire if imported inflation suddenly picks up.

Comfortable, Not Carefree: India’s inflation story may look calm on the surface, but its foundations remain delicate. Sustained low food prices, stable global markets, and a firmer rupee are essential to keep this soft patch from evaporating. For now, India has a window of comfort, the challenge is ensuring it doesn’t close too quickly.

Business India: Dhanda Hai Yeh!

Image Credits: Mint

Adani Eyes Pilot-Training Firm: The Adani Group is reportedly in advanced talks to acquire Flight Simulation Technique Centre (FSTC), its entry point into the aviation training business. The deal would be done through its defence-aerospace arm via Horizon Aero Solutions. FSTC runs multiple simulator centres and flight academies across India. Adani sees rising demand for trained cockpit crew, driven by defence needs and commercial aviation growth. The acquisition would expand Adani’s aerospace footprint significantly.

Reliance’s ₹4.4 Lakh Crore Surge: Reliance Industries has surged over 26% in 2025, adding around ₹4.4 lakh crore to its market value. The rally is being fuelled by a revival in its oil-to-chemicals business, telecom tariff hikes, and strong retail momentum. Analysts further point to value-unlocking triggers, including a potential IPO for its telecom arm, Jio. This marks Reliance’s most powerful bull run since 2020.

Dr Reddy’s Wins EU Approval For Bone Drug: Dr. Reddy’s Laboratories has secured European Commission approval for AVT03, a biosimilar to the bone-strengthening drug denosumab (used in Prolia and Xgeva). The approval covers all EU member states and EEA countries like Iceland and Norway. The product is being developed in partnership with Alvotech, which will handle manufacturing. Dr. Reddy’s will commercialize the drug in Europe under the brand names Acvybra and Xbonzy.

Marriott Sees India Among Top 3 Markets: Marriott International expects India to become its third-largest market within the next two to three years as travel demand accelerates. The company plans aggressive expansion, driven by a strong domestic tourism boom and rising interest from global travelers. Marriott currently operates 161 hotels in India and has 69 more in the pipeline. The group sees India as one of its fastest-growing hospitality opportunities.

Swiggy’s Losses Rise On Quick-Commerce Push: Prosus has stated that Swiggy’s operating losses doubled in the first half of FY25, mainly due to heavy investments in Instamart. While revenue grew strongly, profitability took a hit as the platform pushed for faster deliveries and market share gains. Prosus also highlighted solid growth in Swiggy’s core food-delivery business. The company believes long-term gains justify the upfront spending.

World 🌏

The Oil Tanker Squeeze: Why Freight Rates Are Suddenly Skyrocketing

Image Credits: The Print

A New Shockwave In The Shipping Market: Global oil markets are no stranger to volatility, but this time the turbulence is sailing on water. Freight rates for the world’s biggest crude carriers have shot up to their highest levels in five years, fuelled by a sudden reshuffling of global oil trade. As sanctions tighten around Russian crude, buyers are turning to alternative suppliers and the scramble for ships is rewriting the economics of oil transportation.

Sanctions Push Refiners To New Routes: The latest U.S. sanctions on Russia’s energy giants, including Rosneft and Lukoil, have made buyers wary of touching Russian barrels. That shift has pushed refiners, especially in Asia, to source more crude from the Middle East and the United States. Longer routes and higher demand mean more ships are suddenly needed and very few are available at short notice.

VLCC Rates Hit Five-Year Highs: At the centre of this surge are Very Large Crude Carriers (VLCCs), the giants that move two million barrels at a time. Spot charter rates have leapt to around $137,000 a day, a staggering jump that reflects the tightest tanker market seen in years. Even the broader VLCC index has climbed above $116,000 a day, signalling that this is not a one-off spike but a broad-based squeeze.

Ripple Effects Across Smaller Ship Classes: The stress isn’t limited to the largest tankers. With VLCCs snapped up, refiners are turning to Suezmax and Aframax vessels, which usually cater to shorter or region-specific routes. This spillover is tightening supply across the board. Freight markets are so lucrative right now that some operators are even “dirtying up” clean-product tankers converting them temporarily to carry crude just to ride the wave.

Higher Freight Costs May Lift Oil Prices: For refiners, the math is now shifting. Higher shipping costs could soon translate into costlier crude and, eventually, pricier fuels. With geopolitical shifts still evolving, tanker markets may remain unpredictable well into the next year. What’s clear, however, is that the oil-shipping world is undergoing one of its most significant recalibrations in recent memory.

DuniyaDIARY 🌏📒

Image Credits: ET

Supply Chain Freeze Lingers, FedEx Warns: FedEx cautions that recent global supply-chain shocks, from pandemic hangovers to geopolitical tensions, will continue to disrupt logistics and trade for the foreseeable future. The company expects elevated costs and delivery delays to remain persistent, even as some regions recover. It argues that structural changes, not just cyclical hiccups, are driving this new normal. This shift could force companies to rethink just-in-time manufacturing and expand buffer inventories.

Big Blow For Alzheimer’s Hope: Novo Nordisk’s shares dropped nearly 9% after its Alzheimer’s drug missed a key clinical trial goal, dealing a significant setback to the company’s neuroscience ambitions. The failure raises questions about the future of its pipeline and its ability to pivot quickly in the face of such high-stakes research. Investors will be watching closely for how the company recalibrates its R&D strategy.

Made-in-China Brands Expand In Africa: Chinese consumer brands are aggressively expanding into African markets as traditional infrastructure and resource-investment models give way. Exports to Africa from China have surged by 28%, reflecting a broader shift in trade dynamics and consumer demand. These brands are betting on a growing African middle class and long-term consumer opportunity, not just raw materials. Analysts see the move as part of a more sustainable, consumption-led China-Africa relationship.

Meta Accused Of Blocking Harm Research: A new court filing claims Meta halted internal studies that indicated its platforms could be harming users, particularly young people. The allegations say executives were briefed on the risks but chose not to pursue deeper investigation. The filing could intensify regulatory scrutiny already surrounding Big Tech’s influence on mental health. Meta has not publicly detailed why the research was paused.

US–Ukraine Draft New Peace Framework: Washington and Kyiv are working on a more “refined” peace plan aimed at ending the war with Russia, according to diplomatic sources. The updated proposal focuses on security guarantees, economic support, and phased territorial negotiations. Officials say the plan remains fluid as battlefield conditions shift, but both sides hope it can eventually draw Moscow into talks. No timeline has been set for presenting it formally.

Aur Batao 📰

India Gets Javelin Boost For Stronger Defence: India’s defence capabilities are set to strengthen with the acquisition of U.S.-made Javelin anti-tank missiles under a new agreement. The deal forms part of a broader military partnership aimed at enhancing readiness for high-intensity conflicts. Officials say the move aligns with India’s push for modern, combat-proven systems. The cooperation also signals growing strategic alignment between New Delhi and Washington.

Canada’s PM Carney To Visit India In 2026: Canadian Prime Minister Mark Carney is expected to visit India next year in an effort to reset strained diplomatic ties. The trip will likely focus on trade, mobility, and political cooperation after a period of tension between the two nations. New Delhi sees the visit as an opportunity to reopen stalled discussions, though sensitive issues remain. Formal dates are yet to be announced.

Swiggy, Eternal May Shift Gig Welfare Costs To Users: Analysts say platforms like Swiggy and Eternal could pass on the added expenses arising from India’s new gig workers’ welfare fund. The fund mandates contributions for social protection, increasing operating costs for delivery and ride-hailing firms. Experts warn this could lead to higher fees or service charges. Companies are still evaluating the financial impact.

Indian Woman Detained 18 Hours In Shanghai: A woman travelling from China was held at Shanghai airport for 18 hours after authorities claimed her Indian passport was invalid, arguing that Arunachal Pradesh belongs to China. The incident shows ongoing geopolitical sensitivities and border tensions. She was eventually released, but the episode illustrates the challenges Indians may face on Chinese soil. India has not formally commented on the case yet.

Lush Returns to India Amid Luxury Beauty Boom: UK beauty brand Lush is set to re-enter India as the country’s premium beauty market experiences rapid growth. The move comes after its earlier exit, with the company now betting on stronger demand for cruelty-free and experiential products. Retail analysts expect Lush to tap into affluent urban consumers through selective store launches. The comeback reflects India’s expanding appetite for luxury personal care.