Handpicked updates about India’s business and the business of India

Twenty years after the legendary cobra incident in the athlete's village, India is back baby! Ahmedabad has been officially ratified as the host for the 2030 Commonwealth Games. It’s a historic moment, be gone ghosts (and snakes) of 2010!

Now, let’s get into the Dispatch! 🚀

Today’s reading time is 6 mins.

Markets 🔔🐂🐻

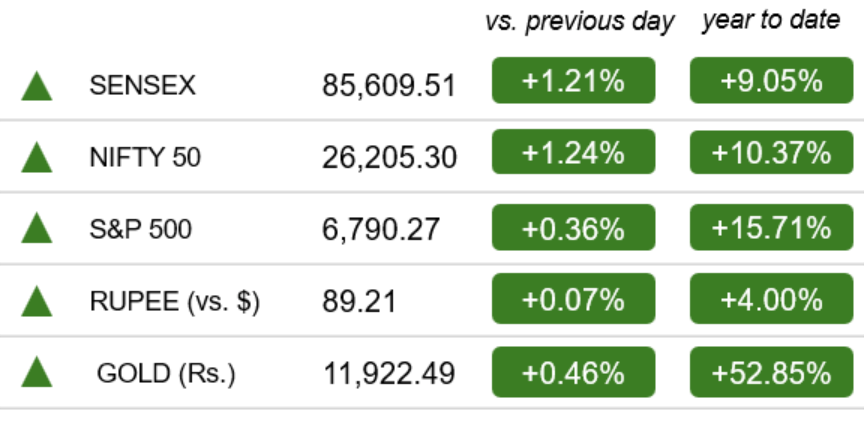

As of the Indian market closed on Nov 26th

The Indian stock market saw strong, broad-based gains on Wednesday, driven by positive global cues. The Sensex soared 1,023 points, and the Nifty 50 rose 321 points, with the Midcap and Smallcap indices also closing sharply higher.

Business & Economy

India’s ₹7,280-Crore Rare Earth Magnet Push

Image credits: Mint

A Big Step Toward Reducing Import Dependence: Rare-earth magnets may be hidden from the public eye, but they power everything that defines the modern world- electric vehicles, wind turbines, smartphones, defence systems. For decades, India has relied heavily on imports, especially from China, for these critical components. Now, with global supply chains under strain and strategic materials turning geopolitical, the government has cleared a ₹7,280-crore scheme to build India’s first integrated rare-earth magnet manufacturing ecosystem.

What the Scheme Really Offers: The newly approved Scheme for Sintered Rare Earth Permanent Magnets aims to create a full value chain right here at home, from rare-earth oxides to metals, alloys, and finally, high-performance magnets. Of the total outlay, ₹6,450 crore is earmarked as sales-linked incentives, while ₹750 crore will go toward capital support during setup. The production target is ambitious: 6,000 metric tonnes per annum, distributed across up to five manufacturers. These players will be chosen through global competitive bidding, ensuring only technologically capable firms make the cut. The scheme will run for seven years—two for setting up facilities and five for production-linked payouts.

A Strategic Move With Long-Term Payoffs: This is more than an industrial-policy announcement; it’s a strategic play. Rare-earth magnets sit at the heart of India’s EV transition, renewable-energy expansion, and advanced electronics manufacturing. By encouraging domestic capacity, the government aims to sharply cut imports, strengthen national security, and support Viksit Bharat 2047’s goal of a self-reliant industrial base. The move also aligns with global efforts to diversify supply chains away from China, which controls over 80% of rare-earth magnet production. A domestic ecosystem could turn India into both a safer and more competitive destination for future industries.

The Road Ahead Isn’t Without Challenges: Creating an end-to-end rare-earth value chain demands deep technical know-how, sophisticated processing capabilities, and stringent environmental safeguards. Market demand, driven by EVs and renewables, will ultimately determine how fast the industry scales.

Business & Economy

Why India Inc Is Suddenly Obsessed With Rebranding Itself

Image credits: ET

A New Wave of Corporate Rebranding: There was a time when Indian companies changed names only after mergers, scandals, or huge structural shifts. Not anymore. Today, rebranding has become a strategic fashion statement. The latest example, Zomato renaming its parent entity to Eternal Limited- has sparked a larger conversation: Why is Corporate India suddenly rewriting its identity?

Zomato Isn’t Alone, The Trend Is Everywhere: Over the past year, Indian companies across sectors have quietly begun dropping their old corporate skins. OYO’s parent became PRISM, some tech startups adopted broader holding-company names, and several legacy firms have refreshed their identities to sound more futuristic, global, or diversified. This shift reflects the evolution of business models, most of these companies no longer want to be seen as “just a food-delivery app” or “just a hotel aggregator.” A wider umbrella identity signals ambition.

Why the Rush to Rename? Experts say a corporate name today is more than a label, it’s a strategic signal. With companies diversifying into fintech, cloud kitchens, logistics, renewables, and more, older names often feel limiting. A neutral or aspirational parent-company name helps create mental space for expansion. There’s also the investor angle. In a market where narratives can move valuations, a new name suggests a new journey. It communicates that the company is evolving, professionalising, and preparing for the next decade. For startups heading toward IPOs, this signalling becomes even more crucial. A modern identity helps them fit into the global corporate mould.

Does It Really Matter? Interestingly, for most consumers, the parent-company name means little. Whether Zomato is owned by Eternal or Alphabet makes no difference to a person ordering dinner. What truly matters is service quality. Branding experts warn that without strong fundamentals, a fancy corporate name risks looking cosmetic, worse, hollow. And there’s no evidence yet that rebranding automatically improves valuation.

Business India: Dhanda Hai Yeh!

Image Credits: ET CIO

Digital Push, Data-Centre Boom: A new joint venture Digital Connexion, between Reliance Industries, Brookfield Corporation and Digital Realty, will pump USD 11 billion (≈ ₹98,000 crore) into building a 1-gigawatt AI-ready data-centre campus on 400 acres in Visakhapatnam by 2030. This signals a major push to scale India’s data-infrastructure as demand surges for cloud, AI and hyperscaler workloads.

Tesla’s EV Play in India: Tesla is intensifying its India outreach with its first full-scale retail/experience centre in Gurugram, a move meant to deepen EV-ecosystem presence beyond mere sales. The company seems focused less on immediate volume and more on shaping long-term EV adoption, including infrastructure and customer experience.

Weak Rupee, Export Edge: The Indian rupee has slipped into its longest undervaluation phase in seven years, with real-effective-exchange-rate metrics showing it remains significantly below fair value. That depreciation, while painful for importers, could prove advantageous for exporters, giving Indian goods a competitive edge globally amid a weak domestic currency.

Office Leasing Hits New Highs: Commercial real-estate leasing in India’s six major cities reached a record high in FY2025, with net office-space absorption hitting 65 million sq ft. The momentum is expected to carry on into FY2026, with vacancy rates projected to shrink further as demand, especially from global capability centres (GCCs), BFSI and IT-BPM firms, remains robust.

Cabinet Clears Rail Push In Maharashtra & Gujarat: India’s cabinet has approved two major multi-tracking rail projects at a combined cost of ₹2,781 crore. The expansion will add about 224 km to the rail network, improving connectivity for roughly 585 villages and a population of around 32 lakh. Freight capacity is projected to increase by up to 18 million tonnes per annum (MTPA) boosting flow of coal, cement, containers, and other goods. For commuters, the new tracks on the Badlapur–Karjat stretch will ease congestion in the Mumbai suburban corridor and improve long-term connectivity toward southern India.

PC Boom: 49 Lakh Units in a Quarter: India’s PC market raced ahead in July-September 2025, posting a record quarterly shipment of 49 lakh units, the highest ever. Growth was broad-based: workstations led with a 14.2% year-on-year jump, desktops grew 11.6%, and notebooks rose 9.5%. Even AI-enabled notebooks exceeded 100,000 units in a single quarter for the first time.

World 🌏

Russia’s Measured Response To The New Ukraine Peace Plan

Image Credits: ABC News

A New Attempt at Ending a Long War: A fresh push to end the Russia-Ukraine war is back on the global table, with the US, Ukraine and European allies shaping a revised “peace framework” during recent negotiations in Geneva. The plan, a refinement of a 28-point proposal developed earlier this year, attempts to balance ceasefire terms, territorial questions, prisoner exchanges and long-term security guarantees for Kyiv. But for a conflict that has now reshaped Europe’s geopolitical landscape, any peace plan faces deep mistrust on all sides.

Moscow Calls It a ‘Basis,’ But Nothing More: Russia’s initial public reaction has been the diplomatic equivalent of a cautious half-step. The Kremlin confirmed receiving the plan and said it could serve as a “basis for a final settlement.” Yet officials were equally clear that no commitments or agreements have been made. Russia’s response remains deliberately ambiguous, a sign that Moscow wants to keep the door open without surrendering negotiation leverage.

Russia’s Red Lines Still Dominate the Equation: Behind the muted tone lie familiar demands. Moscow wants recognition of the territories it has annexed since 2014, restrictions on Ukraine’s future military capabilities, and a permanent block on NATO membership. None of these conditions are acceptable to Kyiv, and even the refined Geneva version acknowledges only minimal room for compromise. Adding to the tension, Russia dismissed Europe’s alternative counter-proposal as “unconstructive,” underscoring how far apart both sides still are.

A Deal With Global Stakes: The stakes extend far beyond the battlefield. A negotiated settlement could stabilize energy markets, reshape NATO’s strategic posture and recalibrate US-Russia relations. Rejecting the plan, however, risks prolonging a grinding conflict that has already drained resources and deepened global divides. For Ukraine, any agreement that appears to “carve up” its territory, a warning voiced by EU leaders is politically explosive.

Can Diplomacy Still Work? The latest plan represents one of the most serious diplomatic efforts in years, but its success hinges entirely on whether Russia sees negotiation as a strategic opportunity or merely a tactical pause. For now, the world watches a fragile opening, one that could lead to peace or simply fall back into familiar stalemate.

DuniyaDIARY 🌏📒

Image Credits: NDTV

UK Budget Tightens the Belt: The UK’s new budget, rolled out by the Labour Party government, raises taxes sharply, freezing income‑tax thresholds and imposing levies on luxury homes, pensions and other areas to close a fiscal gap. The move comes as growth forecasts for the years ahead were revised downward, making the tax hike a necessary, if unpopular, fiscal step. The extra revenues are aimed at shoring up public services while managing rising debt.

200 Jobs Cut at McKinsey: Global consultancy McKinsey & Company has laid off about 200 tech‑focused staff as part of a restructuring push toward increased automation and AI‑driven workflows. The firm said it plans to lean more on AI tools for support functions, while prioritising “client‑facing” roles, a move meant to boost efficiency amid tighter budgets and a changing business environment.

HP Shrinks Team, Bets Big on AI: HP Inc. plans to cut between 4,000 and 6,000 jobs globally by fiscal 2028, about 10% of its workforce, as part of a strategic shift to ramp up AI‑driven product development and customer support. The company expects these cuts to generate roughly USD 1 billion in savings over three years, even as it raises PC prices to offset rising AI‑enabled hardware costs.

Apple Set to Reclaim Crown from Samsung: Thanks to strong global demand for its new iPhone 17 line and a wave of upgrades among users, Apple is on track to overtake Samsung Electronics as the world’s largest smartphone maker in 2025, a title it last held more than a decade ago. According to analysts, a combination of a favourable replacement cycle, rising second‑hand iPhone upgrades and easing US‑China trade tensions is fueling this resurgence.

Taiwan Ramps Up Defence Spending: Lai Ching-te has announced a proposed extra US $40 billion in defence spending to strengthen Taiwan’s deterrence against China, highlighting what he called “no room for compromise” on national security. The move comes amid rising geopolitical tensions and regional uncertainty signalling Taiwan’s intent to significantly expand military readiness over the coming years. How Beijing and regional stakeholders like Japan react could shape the next phase of cross‑strait politics and regional security dynamics.

Middle East’s First Fully‑Driverless Robotaxis: Uber and WeRide have begun commercial operations of Level‑4, fully driverless “robotaxis” in Abu Dhabi, the first such service outside the U.S. on Uber’s platform. Passengers on routes (initially on Yas Island) can now book rides under a new “Autonomous” option in the app with no human driver or safety operator onboard. This marks a major milestone in global smart‑mobility deployment and could accelerate adoption of autonomous transport solutions across the Middle East and beyond.

Hong Kong Tower Fire, Death Toll Rises: A massive fire engulfed multiple high‑rise residential towers at Wang Fuk Court in Hong Kong’s Tai Po district, killing at least 44 people and injuring hundreds, as rescue efforts continue The blaze, fanned by bamboo scaffolding and renovation materials has once again raised serious concerns about building safety standards in the city.

Aur Batao 📰

New Labour Codes Spark Worker Outrage: Ten of India’s largest trade unions mobilised thousands of workers across states on November 26, protesting the government’s freshly enacted four labour codes calling them a “deceptive fraud” undermining job security and workers’ rights. Under the new rules, companies with up to 300 employees can now lay off staff without prior permission, and fixed‑term contracts are easier, changes unions warn will erode collective bargaining and push workers into precarious jobs.

India Hits Back, ‘No Moral Standing’ for Pakistan: India strongly rejected Pakistan’s criticism of the flag‑hoisting at Shri Ram Janmabhoomi Temple in Ayodhya, saying Islamabad has “no moral standing to lecture others,” given its own record of minority repression. The Ministry of External Affairs pointed out that Pakistan should rather introspect on its human‑rights record before commenting on India’s domestic religious affairs.

India Weighs Dhaka’s Extradition Request: India is currently examining an extradition request from Bangladesh for the country’s former party‑leader Sheikh Hasina, as tensions rise indicating careful diplomatic and legal assessment by New Delhi before any decision.