Handpicked updates about India’s business and the business of India

The results are in. Full-time ahimsa promoter and part-time US president, Donald Trump, has unfortunately not won the Nobel Peace Prize. Venezuelan opposition leader María Corina Machado walked away with the honour for bravery against an authoritarian regime. Meh. As should be expected, AI images of Trump receiving the Nobel are making the rounds, promoted by Netanyahu himself. The world of unending entertainment is upon us.

Now, let’s get into the Dispatch! 🚀

Today’s reading time is 6 mins.

Markets 🔔🐂🐻

As of the Indian market closed on Oct 10th

The Indian stock market saw healthy buying on Friday, with the Sensex and Nifty 50 extending gains for a second straight session. The rally was fuelled by optimism that a potential India-US trade deal could be near.

Economy & Personal Finance

The Urban Middle-Class Squeeze: Inflation Drops, But Wallets Still Hurt

Image credits: Mint

When Numbers Don’t Match Reality: The government says the middle class is finally getting relief; budget measures and GST reforms are being touted as easing the financial pressure. Official numbers seem to agree: FY23–24 inflation clocked 5.4%, FY24–25 cooled to 4.6%, and the RBI predicts FY26 at just 2.6%. Yet, everyday life tells a different story - so why does inflation feel higher than the data suggests? The answer lies in how we measure it.

CPI - Why Your Wallet Disagrees: The Consumer Price Index (CPI), India’s official inflation measure, calculates price changes using a weighted basket of goods and services. The problem? The basket is outdated - based on 2012 consumption patterns. Back then, items like OTT subscriptions, cab rides, online education, and cloud services were either luxuries or non-existent. Weightings also skew perception. Rural households spend heavily on food and fuel, so price drops here bring down official inflation. Urban middle-class families, however, spend more on housing, education, healthcare, and lifestyle - areas CPI underrepresents. Result: the “official” inflation number feels detached from daily reality.

Inflation across key urban sectors:

Housing: Rents rising 5–10%; median home prices have more than doubled. Ownership is starting to feel distant.

Healthcare: Medical inflation at 12–15% with insurance premiums and hospital bills rising fast

Education: Private school fee growth outpacing salary growth; urban families spend ₹1.5–5 lakh/year per child.

Food: Staples have surged 50–160%; prices for organic and healthy options are even higher.

Childcare: Metro daycare fees ₹7K–₹9K/month, straining young families.

Cars & Mobility: Average car prices up 50% in five years; GST relief are only partial.

Why It Matters: This isn’t just about discomfort. RBI data shapes interest rates, salaries, pensions, subsidies, and investments. If CPI underestimates the true cost of living, the middle class bears the brunt silently - higher loan burdens, slower raises, and misaligned investment decisions. Policy optimism shouldn’t substitute for real financial relief.

Business & Economy

TCS Unveils Bold Plans, Upward Momentum Or Uncertain Path?

Image credits: Moneycontrol

Layoffs Signal Change: India’s IT giant Tata Consultancy Services (TCS) made headlines this year for steep workforce cuts at home for the first time. Historically, TCS layoffs were rare, with the only other major reduction coming in 2012. The company attributed this to “skill mismatches” and the need for a “future-ready” workforce, avoiding direct reference to AI.

Financial Snapshot: Q2FY26 saw TCS record revenue of Rs 65,799 crore, a 3.7% sequential rise, slightly below Street estimates. Net profit fell to Rs 12,075 crore due to a one-time restructuring expense of ₹1,135 crore. Despite solid numbers, the markets remain cautious about near-term prospects, balancing steady growth against transformative but uncertain AI investments.

The $6–7 Billion AI Pivot: Still, TCS has announced one of its boldest strategic moves yet: a $6–7 billion investment in AI data centres. The plan includes building a 1GW sovereign co-location facility in India over 5–7 years. TCS aims to lease passive infrastructure to hyperscalers, AI firms, Indian enterprises, and sovereign clients. This pivot marks a departure from TCS’s traditional capex-light, services-led model toward capital-intensive AI infrastructure.

Analyst Reactions and outlook: Reactions are mixed. Some see the move as a strategic hedge to capture the explosive AI market. Others warn of low-margin, high-capex risk with limited synergies to core IT services. India’s data centre capacity stands at ~1.2GW but is projected to expand nearly tenfold in five to six years. The sector is expected to attract $20–25 billion in investments. TCS’s plan aligns with the government’s push for onshore data storage and positions it to capture future demand, but at the same time carry risks to returns, free cash flow, and traditional high-margin operations.

Business India: Dhanda Hai Yeh!

Image credits: Wise

Wise’s Travel Card In India: Wise has launched a waitlist for its new travel card in India, offering a cost-effective alternative to traditional forex cards. The launch aligns with UK-India economic collaboration highlighted by PM Keir Starmer during the Global Fintech Festival in Mumbai.

Mitsubishi Electric India Boosts Local R&D, Manufacturing: Mitsubishi Electric India is expanding its localisation drive with new factories in Pune and Chennai, supporting the 'Make in India' and PLI initiatives. The company is also developing semiconductor talent through local partnerships and implementing smart-factory solutions like e-Factory and MaiLab.

Tide to Pump ₹6,000 Crore, Add 800 Jobs: UK fintech Tide plans a ₹6,000 crore investment in India over five years starting 2026, focusing on the growing SME sector. The firm will create 800 jobs in the next year, expanding its local workforce to 2,300 across product development, engineering, marketing, and operations. Since 2022, India has become Tide’s fastest-growing market, serving 800,000+ SMEs.

Papa John’s Plans Comeback In India: Papa John’s is making a comeback with plans to open 650 stores over the next ten years. The first store will launch in Bengaluru, followed by Hyderabad by 2027. This expansion taps into rising discretionary spending after recent tax cuts.

Pegatron Sets Up 5G Plant: Apple supplier Pegatron is establishing a Chennai facility to produce 5G small cells for India’s private telecom market. The plant supports the government’s push for domestic 5G infrastructure and will serve both local and export demands, boosting its footprint in India’s growing telecom sector.

Revolut Plans ₹5,900 Cr Investment: UK neobank Revolut will invest ₹5,900 crore in India over five years to expand its operations and global capability centre. The company aims to onboard 20 million Indian customers by 2030 and broaden its fintech offerings. With a PPI license from the RBI obtained in March 2025, Revolut is preparing to launch its services in the country soon.

India Gains U.S. Clearance For Seafood Exports: The U.S. National Marine Fisheries Service has certified Indian fisheries under the Marine Mammal Protection Act, allowing continued access to the U.S. market. Competitors like China, Mexico, and Ecuador face export bans, giving India an edge. However, high tariffs of around 50% on shrimp exports keep U.S. sales less competitive.

World 🌏

OpenAI, Oracle, Nvidia, AMD: Deals That Impress or Inflate?

Image credits: Ainvest

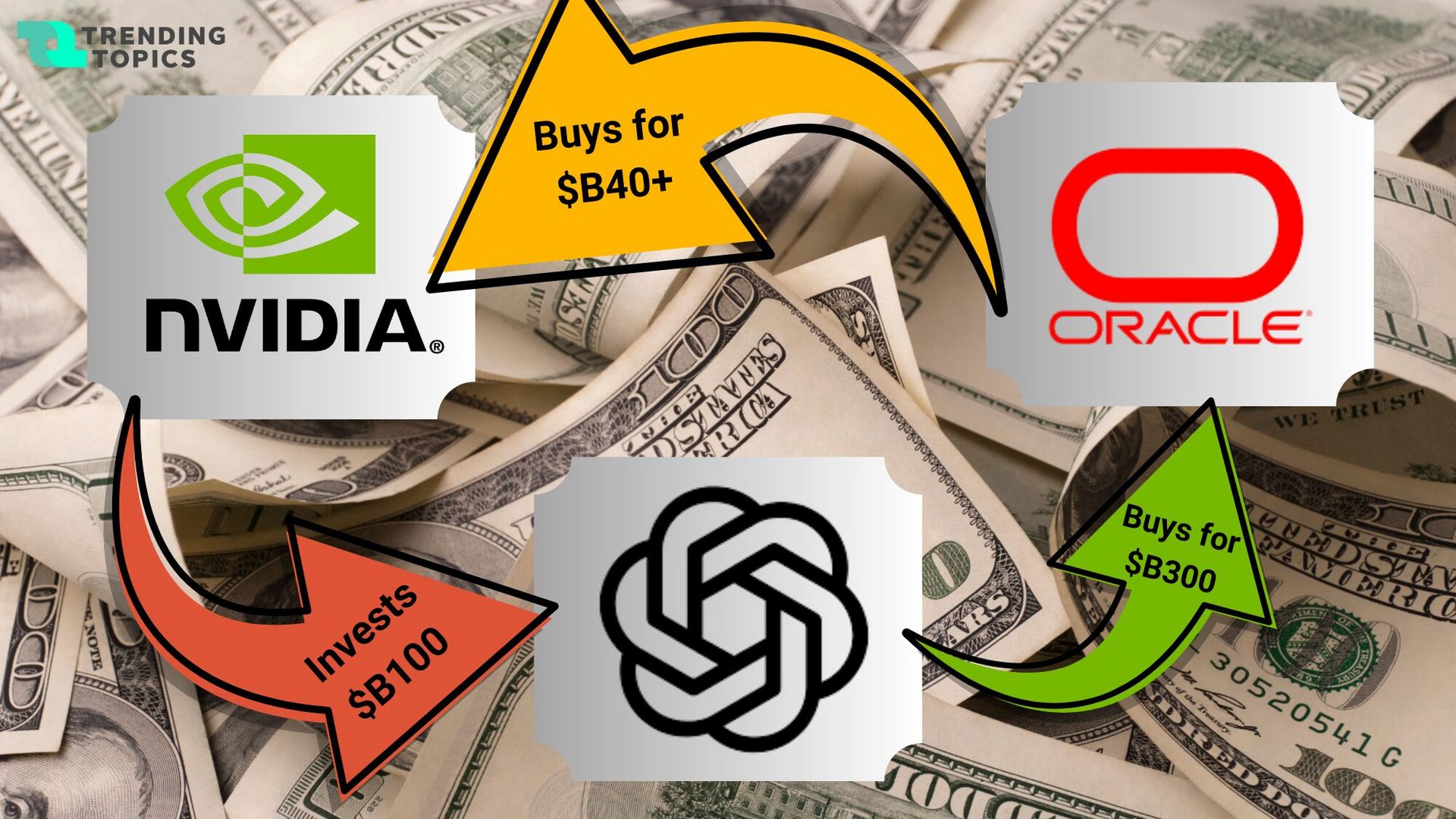

Big AI Moves: The AI boom isn’t just about groundbreaking models and smarter algorithms, it’s also about massive money and financial maneuvering. Recent deals involving OpenAI, Oracle, and Nvidia have grabbed headlines, but the question remains: are these genuine technological leaps or just ways to make the numbers look better?

OpenAI & Oracle: A $300 Billion Cloud Bet: Oracle signed a jaw-dropping $300 billion deal with OpenAI, aiming to beef up OAI’s cloud infrastructure. On paper, it’s a win-win: OpenAI gets reliable cloud capacity, and Oracle can potentially lock in long-term revenue. But analysts are cautious. Such dependence on a single client carries risks, and structuring the deal to boost revenue recognition raises eyebrows about financial optics versus real value creation.

Nvidia’s $100 Billion GPU Push: Nvidia isn’t far behind. Its conditional $100 billion GPU commitment for OpenAI is another massive play. Here again, the way the investment is structured could inflate Nvidia’s financial statements without necessarily reflecting immediate technological gains. Essentially, these deals can make balance sheets look stronger even if the real-world outputs lag behind.

Landmark deal for AMD with OpenAI: Much in the same vein, OpenAI and AMD reached a deal this week, with OpenAI committing to purchase 6 gigawatts worth of chips over multiple years. In turn OAI will receive 160 million shares of AMD, which it could sell to finance the transactions.

Financial Engineering Of AI: Taken together, these agreements highlight a broader trend: the financial engineering of AI transactions. Capital commitments are increasingly treated as revenues, and supplier investments are leveraged to signal demand. While this doesn’t diminish the importance of AI infrastructure, it’s blurring the lines between actual growth and clever accounting.

DuniyaDIARY 🌏📒

Image credits: Neowin

China Hits Back At U.S. Ships With Port Fees: Starting October 14, 2025, China will levy extra port fees on U.S.-linked vessels in response to similar U.S. charges on Chinese ships. Beijing calls the U.S. measures "discriminatory" and warns they threaten global supply chains. The escalating fees are heightening trade tensions, potentially affecting worldwide shipping and commerce.

Rishi Sunak Takes Advisory Roles At Microsoft, Anthropic: Former UK PM Rishi Sunak will serve as a part-time senior advisor to Microsoft and Anthropic, offering guidance on global trends and technology. All earnings will go to his charity, The Richmond Project.

Neuralink Advances With FDA Approval: Elon Musk’s Neuralink has attracted over 10,000 applicants for its FDA-approved human trials. The clinical tests aim to evaluate the company’s brain-computer interface technology, designed to help people with conditions like paralysis.

Sam Altman-Backed Biotech Cleared For MDMA Trials: Arcadia Medicine, backed by Sam Altman, has gained FDA approval for Phase 1 trials of a safer MDMA variant, AM-1002. The trials will focus on treating Generalized Anxiety Disorder while minimizing neurotoxic and cardiovascular risks. Results are expected within a year, indicating rising interest in psychedelic-assisted mental health therapies.

Aur Batao 📰

India Opens Nuclear Power Sector To Private Players: Prime Minister Narendra Modi announced at the India-UK CEO Forum that India will allow private participation in its nuclear power sector. The move seeks to deepen India-UK cooperation and attract investment in clean energy and infrastructure. Modi emphasized that the initiative supports India’s long-term renewable and sustainable growth goals.

Putin Admits Russian Role In Azerbaijani Plane Crash: Russian President Vladimir Putin has acknowledged that Russian air defense systems were responsible for shooting down an Azerbaijani Airlines flight in December 2024, killing 38 people.

U.S. Troops To Oversee Gaza Ceasefire Implementation: The U.S. is deploying about 200 troops to Israel to monitor and support the ceasefire between Israel and Hamas. While no American troops will enter Gaza, the mission will focus on logistics, security, and planning to help transition toward civilian governance in the region.

OpenAI’s Sora Crosses 1 Million Downloads: OpenAI’s video creation app, Sora, has surpassed 1 million downloads within just 10 days of launch, outpacing the early growth of ChatGPT. Released in early October 2025, Sora enables users to generate and edit videos directly from text prompts.