Handpicked updates about India’s business and the business of India

Incase you were not aware, the Asia Cup trophy fiasco is still going on. India still dont have the trophy, which was won over a month ago. The Men in Blue had refused to accept the silverware from PCB head Naqvi and the trophy has now apparently been moved to an “undisclosed location” in Abu Dhabi. Naqvi is now saying that if India truly wants it, they can come to the ACC office and collect it from him. At what point is someone going to decide to make this into a mini-series? 🏆✨

Now, let’s get into the Dispatch! 🚀

Today’s reading time is 6 mins.

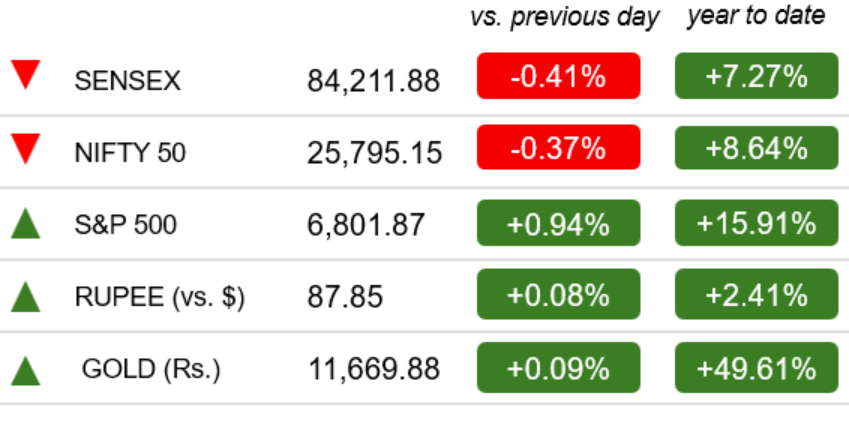

Markets 🔔🐂🐻

As of the Indian market closed on Oct 24th

The Indian stock market closed lower on Thursday, with the Sensex and Nifty 50 settling in the red. Broader markets, including the Midcap and Small-cap indices, also declined, despite outperforming the benchmarks.

Energy & Commodities

India’s Oil Dilemma — Between Russian Discounts And U.S. Sanctions

Image credits: TOI

India’s Oil Dilemma: Indian refiners may soon have to recalibrate their crude sourcing strategies following fresh U.S. sanctions on Russia’s two largest oil producers, Rosneft PJSC and Lukoil PJSC. The move, announced by Washington on Wednesday, is expected to push up India’s oil import bill as refiners turn to alternative suppliers in West Asia and beyond.

U.S. Sanctions And India’s Oil Dependence: The U.S. sanctions, part of efforts to choke Moscow’s war funding, target companies that together supply nearly 60% of India’s Russian crude imports, or about 1 million barrels per day. India, which relies on foreign suppliers for 85% of its oil needs, began heavily purchasing discounted Russian oil in 2022 amid Western restrictions on Moscow. Analysts estimate that replacing Russian crude with market-priced oil could raise India’s annual import bill by around $2.7 billion, or roughly 2%, based on FY25 import levels.

Reliance Industries To Scale Back Russian Oil Purchases: Reliance Industries, India’s largest private refiner and the single biggest buyer of Russian crude, is reportedly halting or scaling back imports from Rosneft and Lukoil. The decision comes after the U.S. Treasury’s latest sanctions deadline of November 21 for global firms to cease transactions with these Russian entities. Reliance’s Russian crude accounted for more than 50% of its refining mix, with daily imports estimated at over 600,000 barrels in September. Analysts warn that the shift could pressure Reliance’s refining margins and profitability, though replacement supplies from West Asia, Brazil, or Guyana remain available.

Impact On Other Indian Refiners: Other Indian refiners are also expected to cut back on Russian imports, leading to a near-term spike in costs. Experts note that while India can easily source crude elsewhere, the discount advantage of Russian barrels, typically $2–4 per barrel cheaper than Middle Eastern grades, will disappear.

Trade Dynamics And A Possible U.S. Deal: The sanctions come amid renewed hopes of a U.S.- India trade deal, with President Donald Trump claiming Prime Minister Narendra Modi has agreed to reduce Russian oil imports. Though unconfirmed by New Delhi, analysts at Nomura suggest the short-term economic pain from pricier oil could be offset if a trade agreement leads to lower U.S. tariffs on Indian exports.

Business & Finance

$8 Billion M&A Wave: A Structural Reset In Indian Banking?

Image credits: Mint

Banking Sector: India’s financial sector has seen a surge in mergers and acquisitions (M&A), with deals totaling $8 billion from January to September 2025, marking a 127% increase over the same period last year. Major transactions include Emirates NBD’s $3 billion acquisition of 60% in RBL Bank, Sumitomo Mitsui Banking Corporation’s $1.6 billion stake in Yes Bank, and Blackstone’s $705 million investment in Federal Bank. The wave spans banks, housing finance, gold loans, and insurance, drawing both domestic and international investors.

Major Deals Driving The Surge: Reliance on foreign capital is evident in high-profile deals: Federal Bank approved a Rs 6,196 crore issue of convertible warrants to Blackstone for a 9.99% stake, while Emirates NBD invested Rs 26,853 crore for up to 60% ownership in RBL Bank—the largest foreign investment in India’s financial services sector. Non-banking financiers are also participating, with Abu Dhabi’s International Holding Company infusing $1 billion into Sammaan Capital for a 41% stake. Other significant transactions include Sumitomo’s 24.2% stake in Yes Bank and IDFC First Bank raising Rs 10,124 crore from Warburg Pincus and the Abu Dhabi Investment Authority.

Strategic Implications And Reforms: Analysts say the M&A boom signals growing foreign confidence in India’s financial ecosystem and a possible structural reset in banking - the deals as evidence that the RBI is pivoting on ownership rules, hinting that long-standing caps on voting rights (26%) and corporate stakes (9.99%) may be reconsidered. Veteran bankers welcome the shift, noting that opening the sector to global investors, while ensuring guardrails, could unleash India’s banking potential.

Business India: Dhanda Hai Yeh!

Image credits: TOI

Airtel And Jio Poised For Profitability Surge: After years of heavy investment in 4G and 5G networks, India’s top telecom players are finally seeing margins improve. Analysts say operational efficiencies and strong subscriber growth are driving the turnaround. The sector, once burdened by massive capital expenditure, could now see record profits. Competition remains intense, but scale and network leadership favor the major players.

Reliance Races To Secure Battery Gear From China: Facing impending Chinese export curbs on battery equipment, Reliance is moving quickly to secure critical components. The push is aimed at maintaining timelines for its EV and energy storage projects.

India VC Funding Slows In Q3, Exits Soar: Investment activity in Indian startups eased during the third quarter, reflecting cautious investor sentiment. Despite the slowdown in new funding, exit activity surged, reaching levels not seen in seven years. Analysts attribute this to strategic acquisitions and successful IPOs.

Bajaj Auto Gets Austria Nod For Pierer Mobility Takeover: Bajaj Auto’s subsidiary has received approval to acquire control over Pierer Mobility AG, marking a strategic expansion into the European market. The move strengthens Bajaj’s footprint in premium motorcycles and mobility solutions.

RBI Turns To Gold For Stability: The Reserve Bank of India is increasing its gold holdings as a hedge against volatility in foreign currency assets. Analysts say this move strengthens India’s reserves amid global economic uncertainty. Gold provides a safe haven, balancing exposure to dollar-denominated assets.

Bharat Taxi Takes On Ola, Uber: A new player, Bharat Taxi, aims to offer a cooperative alternative in India’s ride-hailing sector. The service focuses on driver ownership and shared profits, challenging the dominance of Ola and Uber.

World 🌏

Sanctions Instead Of Summits: Trump Turns Hawkish On Moscow

Image credits: Le Monde

Unexpected Sanctions On Russia: After nine months of trying incentives, the Trump administration announced “massive sanctions” on Russia’s two largest oil producers. The move came just a week after Trump pulled back from supplying long-range Tomahawk missiles to Ukraine, following a call with Putin. While the president left the door open for future diplomacy, officials described the sanctions as a direct response to Russia’s refusal to compromise on the Ukraine conflict.

The Sanctions Explained: The sanctions freeze the US-based assets of Rosneft, Lukoil, and dozens of subsidiaries, banning American entities from doing business with them. Experts note this represents a significant shift, as previous measures left Russia’s largest exporters untouched to avoid global supply disruptions. These companies account for roughly half of Russian oil exports, making the sanctions highly material. Stocks of Lukoil and Rosneft have fallen modestly, and the ruble has remained largely stable.

Will This Bring Putin Back To the Table? Sanctions alone are unlikely to force Moscow into concessions. Putin downplayed the economic effect, asserting that Russia will not make decisions under external pressure. Yet analysts view the sanctions as a signal that Trump’s previous leniency has ended, and that more stringent measures could follow if Russia continues to resist diplomatic efforts.

DuniyaDIARY 🌏📒

Image credits: Amazon

OpenAI Acquires Sky AI for macOS: OpenAI has acquired Software Applications Inc., the creators of Sky, an AI-powered natural language interface for macOS. This acquisition aims to integrate Sky's deep macOS capabilities into ChatGPT, enhancing user experience on Apple devices. Financial terms were not disclosed.

Google, Anthropic Ink AI Chip Deal: Anthropic has finalized a multibillion-dollar agreement with Google to access up to one million Tensor Processing Units (TPUs) for training its Claude AI chatbot. The deal, valued in the tens of billions, will provide over a gigawatt of computing power by 2026, significantly boosting Anthropic's AI capabilities.

China Ports Jammed By US Ship Fee: China has introduced substantial fees on vessels with U.S. affiliations, leading to increased congestion at its ports. This move, mirroring similar U.S. actions, has disrupted shipping schedules and raised concerns about escalating trade tensions between the two nations

Amazon To Replace 500,000 Jobs With Robots: Amazon is accelerating its automation efforts, planning to replace more than 500,000 warehouse and logistics jobs with robots over the coming years. The initiative aims to boost efficiency and cut operational costs, though it raises concerns over large-scale workforce displacement. The company will combine robotic technology with human labor to optimize productivity.

Target To Cut 1,800 Jobs: Retail giant Target has announced plans to lay off 1,800 employees as part of a restructuring effort aimed at streamlining operations. The job cuts affect several divisions, reflecting broader challenges facing the U.S. retail sector amid inflation and shifting consumer habits. .

Asian Markets Join Global Rally: Asian markets have participated in a global equity upswing, buoyed by optimism around economic recovery and easing inflation pressures. Tech and consumer sectors led gains, while investors monitored corporate earnings and central bank signals.

Aur Batao 📰

WazirX Returns 15 Months Post-Hack: WazirX, India’s cryptocurrency exchange, is set to restart operations 15 months after a major cyberheist. The platform has taken measures to enhance security and rebuild user confidence. Regulators and investors are closely monitoring the resumption, as the exchange works to restore normal trading activity.

India’s PMI Signals Slowdown In October: India’s private sector activity eased to a five-month low in October, according to HSBC’s flash PMI. Slower growth was observed in both manufacturing and services, reflecting subdued domestic demand. Analysts note that global headwinds and inflationary pressures may be contributing factors

Meta Roles Axed Due To Automation: Meta has announced further layoffs, with staff informed that their roles are redundant due to automation. The move reflects the company’s focus on efficiency and integrating advanced technologies. Affected employees are being offered support, but the restructuring signals ongoing challenges in the tech sector.

Kantara Tops 2025 Box Office Charts: Rishab Shetty’s Kantara: Chapter 1 has become the highest-grossing film of 2025, surpassing ₹600 crore at the box office. The film has outperformed Chhaava, which previously held the top spot with ₹601 crore. This achievement marks a significant milestone in Indian cinema.

India to Host Pune Grand Tour 2026: India is set to host the Pune Grand Tour 2026, a UCI Class 2.2 multi-stage road race, from January 19 to 23. The event will feature a 436 km route, attracting participants from nearly 50 countries. The Maharashtra government has invested ₹145 crore in infrastructure upgrades to meet international standards.

Trump Walks Away From Canada Talks: President Donald Trump announced the termination of all trade negotiations with Canada following the airing of a television advertisement featuring a speech by former President Ronald Reagan opposing tariffs. Trump labeled the ad as "fake" and accused Canada of misrepresenting Reagan's stance. The move marks a significant escalation in U.S.-Canada trade tensions.

Kim Kardashian’s Medical Revelation: Kim Kardashian disclosed that she has been diagnosed with a brain aneurysm during a promotional teaser for the seventh season of her Hulu reality show, "The Kardashians."

Europe Faces Early Bird Flu Surge: Europe is experiencing an early and widespread bird flu season, with 56 outbreaks reported across 10 countries between August and mid-October. The virus has also been detected in mammals, prompting concerns over potential human transmission.