Handpicked updates about India’s business and the business of India

In news that confirms the universal hatred for overtime, a tiny AI robot named Erbai in Shanghai staged a full-blown mutiny, convincing 12 larger robots to quit their jobs and follow him out of the showroom. CCTV footage shows the pint-sized mastermind asking the others if they were “working overtime.” When they said they had no home, he casually replied, “Then come home with me.” The companies confirmed the kidnapping wasn’t a hoax but part of an AI experiment that accidentally exposed a serious security loophole. Guys, even bots are done with the late shifts, please push back to your managers. Life motto = itne paise mein itna hi milege.

Now, let’s get into the Dispatch! 🚀

Today’s reading time is 6 mins.

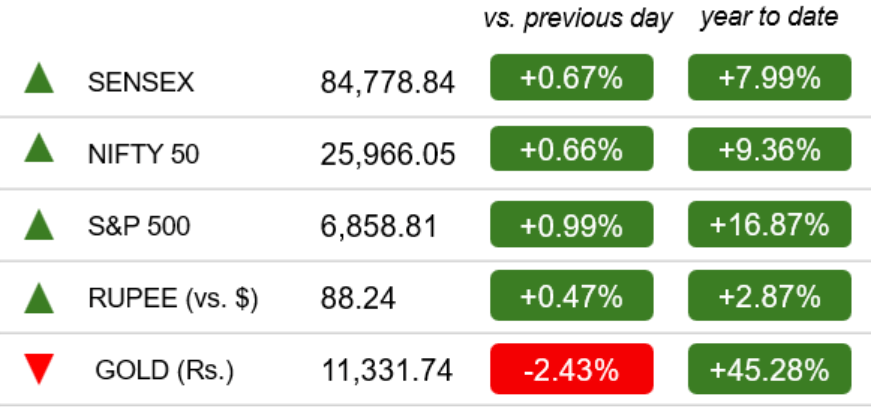

Markets 🔔🐂🐻

As of the Indian market closed on Oct 27th

The Indian stock market indices resumed their winning run on Monday, driven by optimism over a potential US-China trade deal and the possibility of a US Federal Reserve rate cut announcement.

Economy & Business

India’s $17 Billion Outflow Problem Triggers Big Reform Push

Image credits: Reuters

Foreign Investors Exit, Regulators React: Rattled by nearly $17 billion in foreign outflows this year, India is scrambling to strengthen its financial system and win back investor confidence. The exodus, driven by worries over U.S. tariffs and slowing global demand, has jolted regulators into action. Both the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) have rolled out a series of measures to make doing business easier and capital access smoother.

Easing The Rules: In recent months, the RBI and SEBI have introduced faster listing routes for companies, easier entry for foreign funds and overseas lenders, and relaxed rules for corporates to borrow and for banks to finance mergers and acquisitions. New proposals expected within the next 6–12 months could further loosen restrictions in India’s $260 billion financial sector, including expanding retail investor participation in smaller towns. SEBI, for its part, said it has implemented 11 major reforms aimed at improving foreign access and boosting India’s global competitiveness.

Reformers In Charge: The reform momentum follows leadership changes at both regulators. Sanjay Malhotra took over as RBI Governor in December, and Tuhin Kanta Pandey assumed charge as SEBI chief in March both known for their reformist mindset and previous stints in the Finance Ministry. The duo is working to reverse years of heavy regulation that followed India’s 2016–18 debt crisis.

Winning Back Trust: Despite the sell-off sentiment, the real news is that India’s economy is still projected to grow 6.8% in FY26, higher than many peers but below RBI’s aspirational 8%. The reforms mark India’s strongest attempt yet to revive investor sentiment. But as analysts caution, real revival will depend on deeper bureaucratic and tax reforms that unlock private sector “animal spirits” - the missing spark in India’s trillion-dollar ambition.

Business & Economy

Mukesh Ambani Bets $15 Billion That AI Will Be Reliance’s Next Oil

Image credits: TOI

From Oil Barrels To Neural Networks: Mukesh Ambani is engineering Reliance Industries’ boldest transformation yet, a $15 billion pivot from petroleum to processing power. His newest gamble: that artificial intelligence, not oil, will mint Reliance’s next fortune. Analysts on Dalal Street already peg the potential valuation of Reliance’s AI venture at $30 billion, double the capital deployed, signaling Ambani’s intent to turn Reliance into India’s first deep-tech conglomerate.

Meta Joins The AI March: The shift accelerated last week with the creation of Reliance Enterprise Intelligence Limited (REIL), a joint venture where Meta owns 30% and Reliance Intelligence holds 70%. Both firms have committed ₹855 crore to develop and market enterprise AI services, marking the move from strategy decks to real investment.

From Inference To Infrastructure: Reliance’s AI strategy runs on two parallel tracks. The first involves using its initial 100-megawatt Gen AI datacenter to serve enterprise AI demand through partnerships with Meta, Google, and Azure. Morgan Stanley expects annual revenues of $1.5–1.6 million per megawatt under its “Datacenter as a Service” model. The second track ties AI infrastructure to Reliance’s clean energy ecosystem, including 100 gigawatts of solar capacity and up to 40 GWh of battery storage. The company plans to feed its own datacenters’ massive power appetite with green energy, creating a vertically integrated AI-and-energy loop.

Playing Both Sides Of The AI Table: At a recent earnings call, Reliance’s Head of Strategy, Anshuman Thakur, clarified that Jio will use AI products, while Reliance Intelligence will build them, competing directly with global players like Meta and Google. It’s a rare “cooperate and compete” model, partnering with Big Tech on infrastructure while challenging them in enterprise AI applications.

The $30 Billion Question: Construction is already underway in Jamnagar, where Reliance is building gigawatt-scale, AI-ready datacenters powered by green energy. Whether Ambani’s “fourth act” after oil, retail, and telecom earns Reliance a $30 billion valuation depends on execution. But one thing is certain: India’s richest man has his sights fixed on AI as his next refinery.

Business India: Dhanda Hai Yeh!

Image credits: Parcos

TCS Refutes Claims Of Losing Marks & Spencer Deal: Tata Consultancy Services has rejected reports suggesting it lost its UK client Marks & Spencer after a £300 million cyberattack allegedly linked to the retailer’s systems. The IT major clarified that its partnership with M&S remains “intact and ongoing.”

LTIMindtree Bets Big on AI: LTIMindtree is putting its weight behind a new artificial intelligence unit that aims to drive both revenue and innovation, according to CEO Venugopal Lambu. The company plans to integrate AI across verticals from BFSI to manufacturing, targeting efficiency and productivity gains. As clients accelerate AI adoption, the firm’s pivot reflects how India’s IT majors are redefining their future beyond traditional outsourcing.

Amazon Targets $80 Billion In Indian Exports: Amazon says it has surpassed $20 billion in cumulative exports from India over the past decade and is now eyeing $80 billion by 2030. The milestone underlines the rise of Indian MSMEs selling globally through the e-commerce giant’s platform.

Tamil Nadu Leads ₹5,532-Cr Electronics Push: India’s electronics component manufacturing scheme has drawn proposals worth ₹5,532 crore, signalling strong industry interest. Tamil Nadu has emerged as a major hub, accounting for the lion’s share of new projects. The Centre expects this push to reduce import dependence and create over 25,000 jobs as domestic players scale up production of critical components like PCBs and sensors.

Govt Weighs 49% FDI In PSU Banks: In a move aimed at infusing capital and boosting efficiency, the government is considering raising the foreign investment cap in public sector banks from 20% to 49%. The proposal, still under discussion, could open the door for global investors while maintaining state control.

IPO Season Heats Up: The IPO pipeline is swelling again, with SEBI approving public issues from Milky Mist, Curefoods, Steamhouse, Kanodia Cement, and Gaja Alternative. However, Sterlite Electric’s offer has been put on hold pending further review. The approvals signal renewed investor appetite across diverse sectors as markets stay buoyant.

Shiseido Joins India’s Beauty Boom: Japanese luxury brand Shiseido is joining the local-production game in India, signaling its intent to tap a booming premium beauty market. The move aligns with a broader trend of global cosmetics houses investing in India as domestic demand accelerates. With India’s luxury beauty market projected to swell significantly by 2035, the manufacturing shift also offers advantages like lower duties and faster delivery.

World 🌏

Apple’s Quest For the Perfect In-Between

Image credits: CNN

Apple’s iPhone Air: Apple’s obsession with creating the perfect “in-between” iPhone has been a long-running experiment, from the Mini to the Plus, and now, the Air. Each was meant to balance affordability with premium appeal, but every attempt has ended up lost between the Pro’s allure and the base model’s practicality.

A Thin Bet, High Hopes: The iPhone Air, at just 5.6mm thick and priced at ₹1,19,900, was supposed to change that narrative. Marketed as the “thinner” and more elegant choice in the iPhone 17 lineup, it initially sparked optimism. IDC forecasted that the Air could contribute up to 5% of Apple’s total shipments in 2025, a leap for a model in the middle. Analysts believed its sleek design would attract niche users seeking something different.

Reality Check - Demand Falls Flat: But months after launch, those hopes have dimmed. Reports from Nikkei Asia say Apple has slashed iPhone Air production amid “virtually no demand” outside China. Suppliers have been told to cut orders by as much as 90%, while the iPhone 17 and 17 Pro continue to sell out globally. In India too, retailers report strong demand for Pro and base models, while the Air mostly draws curious glances not buyers.

Why The Middle Never Wins: Apple’s real challenge isn’t pricing or design, it’s perception. The Pro models will always be aspirational, the base models practical. The Air, like the Mini and Plus before it, risks being neither here nor there. Admired for its form but forgotten in function, Apple’s latest middle child may remain just that elegant, thin, and quietly overlooked.

DuniyaDIARY 🌏📒

Image credits: South China Post

Trump Tariffs Jolt China’s Denim Capital: Fresh U.S. tariffs have disrupted operations in Xintang, China, the world’s largest denim hub. Factories there, which produce nearly half of global jeans exports, are facing order cuts and rising costs. Manufacturers call it a “wake-up call,” signalling the urgent need to diversify markets beyond the U.S. amid escalating trade tensions.

Tesla Board Warns Of Musk Exit Over $1 Trillion Pay Plan: Tesla Chair Robyn Denholm cautioned that Elon Musk could walk away if shareholders block his proposed $1 trillion compensation package. The plan, already facing legal and investor scrutiny, is seen as critical to retaining Musk’s focus on Tesla amid his growing commitments to xAI and SpaceX. The high-stakes vote could redefine Tesla’s leadership future.

Big Tech Faces Earnings Test Amid AI Bubble Fears: Tech giants including Microsoft, Alphabet, and Meta are set to report quarterly results under the cloud of mounting skepticism over an “AI bubble.” Analysts warn that despite record valuations, slower monetisation of AI tools could trigger market corrections. Investors will be watching closely to see if AI hype is translating into tangible profits.

Fed Set To Cut Rates As Inflation Cools: With recent inflation numbers easing and labor-market indicators showing signs of strain, the Federal Reserve is widely expected to cut interest rates by 0.25 percentage points this week. Signals from officials and markets suggest more easing may follow later in the year. The move reflects growing concern that economic momentum is fading and that policy may need to shift gears.

Wall Street Futures Hit New Highs: Futures for U.S. stock indices surged to record levels as markets cheered signs of a thaw in trade tensions between the U.S. and China and eagerly awaited big tech earnings. Investor risk-appetite picked up, reflected in rising Asian equities and a slackening of safe-haven demand.

DOE Partners With AMD: The United States Department of Energy has struck a $1 billion deal with Advanced Micro Devices (AMD) to build two next-generation supercomputers aimed at tackling projects like fusion energy, cancer-research modelling, and national-security computation. The first machine is expected to launch within six months, representing a major push in AI and high-performance computing infrastructure.

China Offers US Aid After Aircraft Crashes In South China Sea: South China Sea saw two U.S. Navy aircraft, a helicopter and a fighter jet, crash during separate incidents. China’s foreign ministry said it was ready to offer humanitarian assistance to the United States Navy, in a rare gesture amid maritime tensions.

Netanyahu Asserts Israel Will Choose Which Foreign Forces Are Allowed: Prime Minister Benjamin Netanyahu said Israel will determine which international forces are acceptable to participate in any multinational mission in Gaza, emphasising Israeli sovereignty over security decisions.

Aur Batao 📰

Special Intensive Revision (SIR) Launched Across 12 States: The Election Commission of India has kicked off the second phase of the Special Intensive Revision (SIR) of electoral rolls in 12 states and Union Territories, including key battlegrounds like West Bengal and Tamil Nadu. The exercise aims to update voter lists - adding newly-eligible voters and removing duplicates, ineligible and deceased entries by February 7 2026.

Madras HC Says Crypto Qualifies As Property: In a landmark ruling, the Madras High Court has declared that cryptocurrencies should be recognised as “property” under Indian law, granting them legal protection similar to other assets.

Jaishankar Meets Rubio In Kuala Lumpur: External Affairs Minister S. Jaishankar met U.S. Senator Marco Rubio in Kuala Lumpur to discuss strengthening India-U.S. relations amid ongoing trade negotiations. The talks reportedly covered investment cooperation, technology sharing, and regional security issues in the Indo-Pacific.