Handpicked updates about India’s business and the business of India

WhatsApp may introduce a new feature to let users reserve unique usernames, meaning the era of sharing phone numbers is coming to an end, and instead you’ll be sharing your username. Ah the infinite pain of searching for how many permutations your name will need to be unique. Or just how much funny is the right funny for the username. Thanks WhatsApp. Appreciate it.

Now, let’s get into the Dispatch! 🚀

Today’s reading time is 6 mins.

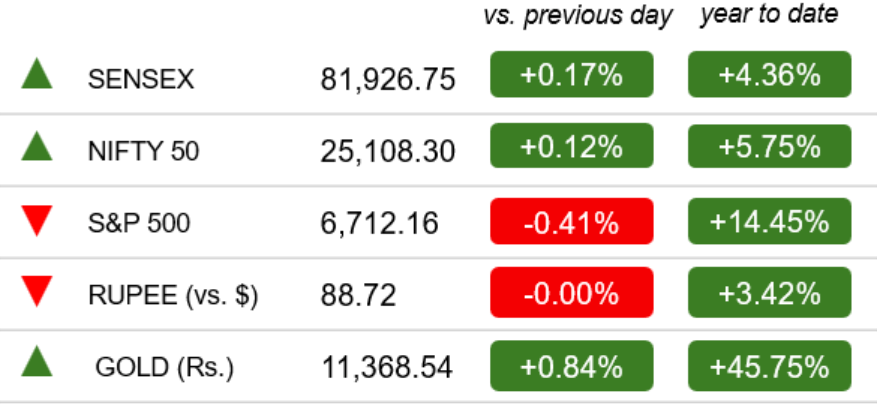

Markets 🔔🐂🐻

As of the Indian market closed on Oct 7th

The Indian stock market indices rallied for a fourth straight session on Tuesday, driven by continuous buying of heavyweights amid mixed global cues. The ongoing gains are fuelled by investor confidence in healthy growth-inflation dynamics and the positive impact of recent GST reforms.

Technology & Innovation

Can Ola’s Ferrite Motor Derisk India’s EV Revolution?

Image credits: Outlook Business

The Rare-Earth Challenge: India’s electric vehicle (EV) industry has faced a persistent hurdle: reliance on rare-earth metals largely controlled by China. Elements like neodymium, dysprosium, and samarium are critical for electric motors, and Chinese export restrictions have disrupted supply chains. The shortage comes at a time when India’s EV sector is accelerating. Sales crossed 2 million units in 2024, up 24% from the previous year, led by electric two-wheelers. Production of Bajaj Auto’s Chetak almost stalled, while TVS Motor warned of potential manufacturing halts due to the scarcity of rare-earth magnets. Although China eased some export restrictions after talks with Indian officials in August, experts caution that this is a tactical gesture, reflecting India’s deep dependency. Over 70% of critical imports come from China, and India’s domestic rare-earth output contributes less than 1% globally due to technological, regulatory, and infrastructure challenges.

Ola Electric’s Ferrite Motor: Enter Ola Electric. The company claims to have developed a rare-earth-free ferrite motor that could insulate India’s EV industry from global supply shocks. Unlike conventional motors that rely on neodymium-based permanent magnets, Ola’s motor uses ferrite magnets - abundant, cheap, and sourced domestically. Tests by the Global Automotive Research Centre in Tamil Nadu confirmed that net power matches conventional rare-earth motors, while maintaining efficiency, performance, and durability. Ola plans to integrate these motors across its scooters and motorcycles, reducing both costs and supply-chain risks.

Challenges Ahead: Still, Ferrite motors face engineering hurdles. Weaker magnets require larger rotors or more windings, which complicates packaging. Demagnetization risks and the brittleness of ferrite magnets could impact performance. Scaling production while maintaining efficiency, durability, and cost advantages remains a long-term challenge. Other EV makers, including TVS, are exploring ferrite motor adoption, signaling a possible industry-wide shift toward rare-earth-free designs.

Aviation

Tight Seats, Fat Fares: India’s Flights Aren’t Getting Cheaper

Image credits: BS

What’s Driving India’s Air Ticket Prices? India’s domestic airfares remain high despite lower crude oil prices and improved aircraft availability. According to Elara Capital, domestic air traffic fell 3% year-on-year in Q2 FY26 after growing 11% in Q4 FY25. The main reason is shrinking fleet sizes among non-IndiGo carriers, particularly the Tata Group airlines - Air India, Vistara, and Air India Express.

Fleet Strategy, Replacement Over Expansion: Even after 15 new planes were delivered by Boeing and Airbus, Tata Group airlines’ combined fleet dropped 4% to 275 aircraft. Analysts suggest this reflects a replacement strategy, phasing out older jets rather than adding new routes. In contrast, IndiGo continues to expand aggressively, growing its fleet by 10% YoY and adding nearly half of its domestic capacity on routes where it competes with Tata carriers. This effectively creates a duopoly in Indian skies. The Directorate General of Civil Aviation (DGCA) has urged carriers to add flights during festive seasons to prevent fare spikes, but capacity remains tight overall.

Cheaper Oil Doesn’t Mean Cheaper Tickets: Global crude prices hover around $65 per barrel, but this has not translated into lower fares. Airlines are using savings to repair balance sheets, cover higher leasing costs, and manage engine replacements. Lower operational costs are not being passed on to passengers as keeping pricing at current levels is seen as a strategic move.

Passenger Growth vs Capacity: Domestic air traffic is projected to grow 7–10% this year. DGCA data shows 161 million domestic passengers in 2024, up from 152 million in 2023. Fleet reductions by major carriers in this time of growing demand is driving limited capacity and keeping fares firm.

What It Means For Flyers: Short-term fare relief is unlikely even during festive seasons. Airlines are focused on profit recovery and operational stability rather than competing through discounts. Travellers can expect busy skies and stable or rising ticket prices in the near term.

Business India: Dhanda Hai Yeh!

Image credits: The Hindu

Adani Defence Tax Probe: Indian authorities are probing Adani Defence for allegedly evading $9 million in import taxes on missile components by misclassifying them to claim duty exemptions. The investigation, launched by the Directorate of Revenue Intelligence in March, targets non-explosive parts used in short-range missiles. The Adani Group says clarifications have been provided and views the matter as closed. The potential penalty could reach $18 million, over 10% of the company’s 2024–25 revenue.

LG India IPO Fully Subscribed: LG Electronics India’s ₹10,000 crore IPO saw strong investor demand, fully subscribed on its first day. Valued at ₹71,000 crore, the IPO proceeds will fund LG’s expansion in India’s home appliance market, targeting new products and growth in smaller towns. Shares are set to begin trading on October 14.

India IT Sector Faces Another Soft Quarter: Major players like TCS, Infosys, and HCLTech are expecting single-digit revenue and profit growth. Global economic uncertainties, U.S. trade tensions, and proposed outsourcing taxes are weighing on client spending. Analysts project around 6% revenue growth and 5.5% profit rise for the September quarter, marking the eighth consecutive slow quarter.

Challenging Quarter For JLR: Jaguar Land Rover, part of Tata Motors, faced a tough quarter with wholesale sales down 24.4% and retail sales falling 17.1%. The decline was driven by the phase-out of older Jaguar models and a September cyberattack disrupting production.

India Maritime Week 2025 To Boost Investments: India Maritime Week (IMW) 2025, set for October 27–31 in Mumbai, seeks to create investment opportunities worth ₹10 lakh crore in maritime and allied sectors. The event will feature delegations from over 100 countries, state-level sessions, and panels on logistics and infrastructure, along with a conference highlighting women in maritime.

India Launches Rupee Settlement System: India has launched a foreign currency settlement system at GIFT City to enable cross-border trade in rupees and strengthen its position as a global financial hub. The initiative aims to boost trade with neighboring countries, promote the rupee in international transactions, and reduce reliance on foreign currencies.

Adani To Expand Navi Mumbai Airport: Adani Group will invest ₹30,000 crore to expand Navi Mumbai International Airport, with passenger operations expected to start in December. PM Narendra Modi will inaugurate the first phase on October 8. The expansion follows an initial ₹20,000 crore investment, with the second-phase terminal planned for completion by 2029.

SP Group Eyes Partial Exit from Tata Sons: Tata Trusts and Tata Sons are in talks to allow Shapoorji Pallonji (SP) Group a partial exit from its 9% stake in Tata Sons. The SP Group, burdened with around ₹30,000 crore in debt, may dilute 4–6% of its stake to raise liquidity. Discussions also involve internal Tata Trusts differences and potential government oversight.

Govt Targets FY-End Sale of IDBI Bank Stake: The Indian government aims to complete the sale of 60% stake in IDBI Bank within the current fiscal year. As of current, the government owns 45% stake and state-owned LIC owns 49% stake currently in the bank. Financial bids are expected between October and December 2025 and the deal could attract buyers like Emirates NBD and Prem Watsa.

World 🌏

AMD Eyes Nvidia’s Turf With OpenAI Pact

Image credits: Quartz

AMD, AI Chip Market: AMD just inked a landmark deal with OpenAI. The partnership will see OpenAI buying tens of thousands of AMD chips to support around 6 gigawatts of AI inference capacity. This move positions AMD as a credible competitor to Nvidia, which currently dominates over 75% of the AI chip market.

A Win Under CEO Lisa Su: Under Lisa Su, AMD has shifted focus from gaming and PCs to data-center processors tailored for AI workloads. The strategy has transformed the company’s market value from under $3 billion in 2014 to more than $330 billion today. The OpenAI deal reinforces AMD’s role in high-demand AI applications. AMD has ‘financed’ this deal by giving OpenAI 160 million AMD shares at a nominal price of 1 cent each, contingent on OpenAI hitting deployment milestones and AMD reaching a certain stock valuation. In this way, the stock will help pay for the chips. Some financial engineers were paid top dollar to come up with this scheme.

Competing With Nvidia: AMD’s MI450 chips, slated for deployment starting late 2026, are designed for AI inference workloads. While Nvidia’s GPUs dominate AI training, inference offers a more commercially viable route, and AMD aims to provide cost-effective, scalable solutions.

Shifting Industry Demand: The AI market is evolving from training-heavy workloads to inference-focused deployments. Efficient inference chips are becoming critical as AI models scale, opening opportunities for competitors like AMD and other entrants such as Broadcom.

DuniyaDIARY 🌏📒

Image Credits: EuroNews

Armstrong Named xAI CFO: Elon Musk has named Anthony Armstrong, ex-Morgan Stanley banker, as CFO of his AI company xAI. Armstrong will manage finances for xAI and X, replacing Mike Liberatore, who left amid disputes over corporate structure and targets.

IKEA Acquires Locus For Delivery Boost: IKEA has acquired U.S. logistics tech company Locus to improve delivery operations and support online growth. The AI-driven platform is expected to cut global delivery costs by about €100 million annually while offering customers more options and real-time tracking. Locus will continue serving other clients independently.

Google Raises AI Bug Bounty To $30K: Google has increased rewards in its AI Vulnerability Reward Program, offering up to $30,000 to ethical hackers who uncover critical security or abuse risks in its AI systems. Since launch, over $430,000 has been paid to researchers reporting AI vulnerabilities.

Airbus A320 Becomes World's Most-Delivered Jet: Airbus has overtaken Boeing as the most-delivered jetliner manufacturer, with the A320 family reaching 12,260 deliveries, marked by a recent handover to Saudi airline Flynas.

Meta Nears Data Privacy Settlement In Nigeria: Meta Platforms is nearing a settlement in a data protection lawsuit filed by Nigeria’s National Information Technology Development Agency (NITDA). The case alleged that Meta violated local data protection laws. While terms of the agreement remain undisclosed, the move shows Meta’s efforts to resolve regulatory disputes in key markets amid global scrutiny over data privacy.

Aur Batao 📰

India’s Salaries Set To Rise 9% In 2026: Aon’s 2025–26 survey projects an average 9% salary increase in India for 2026, up from 8.9% in 2025. Real estate, infrastructure, and NBFCs are expected to lead pay growth. Attrition rates are forecasted to decline to 17.1%, reflecting better employee retention.

Maharashtra Floods: September 2025 floods in Maharashtra damaged crops on 6.87 million hectares, hitting the Marathwada region hardest. The state government is preparing a proposal to seek central financial aid for affected farmers. Chief Minister Devendra Fadnavis is reviewing measures to provide relief and support recovery efforts.

India Rolls Out Biometric UPI Payments: From October 8, 2025, India will implement biometric authentication for instant UPI payments, using fingerprints and facial recognition. This shift follows RBI guidelines allowing alternatives to numeric PINs.

ATP Mulls Heat Policy After Shanghai Retirements: The ATP is considering a formal heat policy after several retirements at the 2025 Shanghai Masters due to extreme heat and humidity. Current weather-related suspensions are handled on-site by ATP supervisors with medical teams. The proposed policy is being discussed with players, tournaments, and experts to ensure player safety.

Kamath Flags Idle Gold Investment Paradox: Zerodha CEO Nithin Kamath pointed out that around ₹2.5 lakh crore of household gold in India remains idle while companies seek capital. He emphasized the need to mobilize this dormant gold through innovative financial solutions beyond traditional loans. Kamath also spotlighted gold’s stability versus equities’ higher but volatile returns over 1996–2025.