Handpicked updates about India’s business and the business of India

Forget Mumbai’s glamour or Gurgaon’s swagger, Pune is making news for being India’s Vaastu capital. While cities across India are chasing gold-priced square feet, Pune’s homes are simply facing the right direction. 56% of homes currently listed for sale in the city are described as Vaastu-compliant in a recent report. Whoever went around these cities checking which house is facing east needs a raise.

Now, let’s get into the Dispatch! 🚀

Today’s reading time is 7 mins.

Markets 🔔🐂🐻

As of the Indian market closed on Sept 16th

The Indian stock market indices rallied on Tuesday, with the Sensex closing nearly 595 points higher. The surge was primarily driven by investor optimism over ongoing trade talks between India and the United States.

Economy & Business

India’s Semiconductors’ Missing Pieces

Image credits: Bisinfotech

The Import Challenge: India’s ambitious semiconductor and electronics manufacturing drive is running into an unexpected hurdle - restricted access to critical raw materials. Industry executives say that essential inputs like gold wire, solder paste, epoxy compounds, palladium-coated wires and lead frames are difficult to procure due to licensing restrictions from the Directorate General of Foreign Trade (DGFT) and high customs duties. These restrictions, they argue, are impeding the country’s cost competitiveness and slowing down the momentum needed to attract global supply chain investments.

The Industry’s Proposal: To address this, semiconductor and electronics manufacturers have proposed a 10-year, zero-duty import regime under the Import of Goods at Concessional Rate of Duty (IGCR) framework. This, they believe, would not only enhance cost efficiency but also reduce India’s dependency on external supply chains and encourage multinational suppliers to invest locally. The Electronics Industries Association of India (ELCINA) has identified 25 such critical materials that are often available only through a handful of globally accredited distributors. This makes sourcing especially difficult for smaller firms without deep networks or bargaining power.

Bottlenecks In Procurement: Among the most pressing challenges are specialised materials like gold-based solder alloys, silver epoxy syringes, solder paste, palladium and gold-coated copper wires. These are indispensable for advanced packaging plants (ATMP and OSAT) and printed circuit board makers, yet require special licences for import.

Quality Control Orders Add Pressure: The hurdles may soon get steeper. With new quality control orders (QCOs) on steel and copper imports taking effect from October, the industry expects further complications in accessing high-grade, specialised materials. Semiconductors require consumables of extremely high purity, often developed through years of research and closely held by a few global players.

Why The Government Is Cautious: Officials argue that strict licensing rules exist for a reason. Many of these materials, especially those with high silver content, are vulnerable to misuse, as precious metals can be extracted from them. For instance, any material with more than 2% silver currently requires a licence. Companies are now working with the government by submitting end-use certificates to prove their requirements are strictly for semiconductor manufacturing. Industry insiders say that as India starts importing many of these materials for the first time, clarity over their usage will eventually make it easier to regulate flows without stifling industry needs.

The Road Ahead: The consensus across the sector is: if India is to realise its semiconductor ambitions, policy flexibility on raw materials is non-negotiable. A zero-duty import window, faster licence approvals, and a framework for global suppliers to set up shop in India could help bridge the gap. For now, though, shiny new fabs face a sobering reality - you can’t build chips without the glue, wires, and gases that hold them together.

Technology

India’s AI Ambition Faces a Data Hurdle

Image credits: RedShark

A Big Push From The Government: Since the start of the year, the Indian government has gone all-in on artificial intelligence. The IndiaAI mission, backed by nearly ₹10,000 crore, promises subsidies for GPUs, incentives for indigenous AI models, and support for startups building in the space. The initiative has already selected early players such as SarvamAI, Soket Labs, and Gnani.ai, with more including Tech Mahindra and Fractal expected to be announced soon. The mission comes at a moment when India is racing to develop its own Indic language models, seen as vital for unlocking the country’s vast digital population. There is, however, one big challenge that money alone cannot fix: a severe shortage of high-quality language data.

The Data Drought: For AI models to work well, they need massive, diverse datasets. But for Indian languages, those datasets are fragmented, inconsistent, or simply unavailable. Startups say that without this backbone, building truly competitive models is nearly impossible. Adding to the challenge, bots that scrape online content to train models, are increasingly being blocked to protect creators’ work. While this is a welcome step for intellectual property, it makes collecting up-to-date information even harder for young firms.

Global Competition Heats Up: Even as Indian startups struggle with these challenges, global giants like OpenAI and Google’s Gemini are steadily improving their capabilities in Indic languages. That raises the stakes for local players. The government has opened up Doordarshan archives to provide culturally rich training material, but the scale of the task remains daunting. Without faster access to licensed data and a clearer framework for content usage, India’s AI mission risks falling behind despite the funding.

Business India: Dhanda Hai Yeh!

Image credits: BBC

JLR Production Halted: Tata-owned Jaguar Land Rover (JLR) has extended its production halt until September 24 due to a cyberattack. A hacker group called "Scattered Lapsus$ Hunters" claimed responsibility, and the shutdown is estimated to be costing the company approximately £50 million a week, with over 1,000 cars typically built daily. The attack has also created supply-chain stress and is causing delays for UK garages needing parts.

India-US Tariff Roadblock: A report by the Global Trade Research Initiative (GTRI) suggests a breakthrough in the India-US trade deal is unlikely unless Washington drops the extra 25% tariff on Indian goods, which is tied to India’s Russian oil purchases. This adds to an earlier 25% levy, bringing the total duty to 50%.

Ola's Production Milestone: Ola Electric has reached a significant milestone by producing 1 million vehicles from its Futurefactory in Krishnagiri, Tamil Nadu, in under four years. The company's growth is largely attributed to its S1 electric scooter series and the newly launched Roadster X electric motorcycles.

Gaming Industry Job Cuts: India's blanket ban on real-money gaming has led to nearly 2,000 layoffs across major firms, including MPL, Head Digital Works, Games24x7, Zupee, and PokerBaazi. According to staffing firm Xpheno, more cuts are expected from the top seven firms, which employ a total of around 6,000 people.

Ambani’s $200 Billion Retail Play: Mukesh Ambani is reportedly preparing to take Reliance Retail public in 2027, with a target valuation of nearly $200 billion. This move is expected to follow the planned IPO of Reliance Jio in 2026. To prepare for the listing, Reliance is streamlining its retail operations by demerging its consumer goods unit and closing underperforming stores to improve margins.

Shipping Push: India is allocating ₹5,000 crore in low-interest loans for shipbuilding and shipping projects. This is part of a larger plan to establish a Maritime Development Fund (MDF) with a corpus of ₹25,000 crore. The fund will be a public-private partnership, with up to 49% of the contribution coming from the government.

Tyre Industry Growth: India's domestic tyre industry is projected to experience a massive 12-fold revenue growth, reaching ₹13 lakh crore by 2047, according to a joint report by the Automotive Tyre Manufacturers Association (ATMA) and PwC India. This surge is fuelled by strong domestic demand from the original equipment manufacturer (OEM) sector, the replacement tyre market, and a significant expansion of vehicle exports.

World 🌏

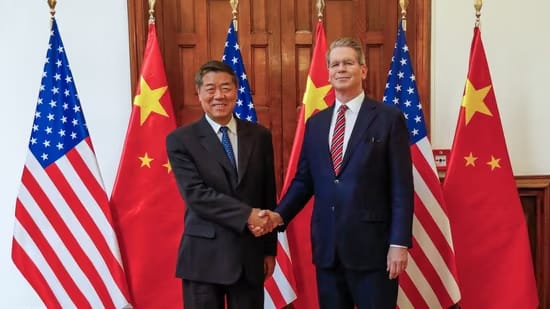

The US-China TikTok “Deal” Tightrope

Image credits: HT

Framing A Deal: The United States and China have struck a framework agreement aimed at shifting TikTok’s U.S. operations under American control. The deal, announced just days before a scheduled ban on TikTok in the U.S., signals a compromise: preserving access to the popular app while addressing Washington’s concerns around national security and handling of data. Though many details are still under wraps, the broad strokes are that an American entity is expected to take charge of TikTok’s U.S. business, data handling, servers, and perhaps even oversight of its recommendation algorithms.

Who’s Likely To Lead This Transition? Oracle is the front-runner in this deal. Its executive chairman, Larry Ellison, has been floated repeatedly as the probable lead of the group that would take over TikTok’s U.S. operations. Ellison was earlier mentioned in relation to purchasing TikTok’s U.S. arm if a divestiture was mandated. Official statements are cautious: both governments agree it’s a private deal, and the precise corporate or ownership structures remain undisclosed. It has not been confirmed if the U.S. government itself will take equity or oversight stakes.

Why This Matters: This compromise addresses a delicate balancing act: protecting national security, maintaining freedom of expression, and respecting international business norms and IP protections. If successful, the deal could set a precedent for handling global tech firms caught between geopolitical interests. However, much depends on execution. Key questions remain: will the algorithm licensing meet security standards, will data truly be localised or controlled in ways that satisfy both U.S. and Chinese regulators, what will the privacy implications be for U.S. users, and how quickly can this transition happen without disrupting the user experience?

DuniyaDIARY 🌏📒

Image credits: WSJ

Ford to Cut 1,000 Jobs: Ford will slash up to 1,000 jobs at its electric vehicle plant in Cologne, Germany, as softening demand forces the company to shift to a single production line from January 2026. Workers will be offered voluntary redundancy packages, but the move highlights the mounting pressure automakers face in Europe’s slowing EV market. The Cologne cuts form part of Ford’s wider restructuring in Germany, including changes at its Saarlouis plant, as the company recalibrates its electric strategy.

Vietnam Urges U.S. To Rethink Seafood Export Ban: Vietnam has formally asked the U.S. to reconsider a planned ban on some Vietnamese seafood exports, which is set to begin January 1, 2026, if certain fishing methods aren’t deemed compliant with U.S. marine mammal protections. The U.S. decision stems from NOAA denying Vietnam a “comparability finding” under the Marine Mammal Protection Act for 12 fishing methods. Given that the U.S. is one of Vietnam’s biggest seafood markets, receiving over $1.24 billion in exports through August, the potential loss looms large.

Alphabet Joins The $3 Trillion Club: Alphabet (Google’s parent company) has crossed a major financial milestone, becoming only the fourth company ever to hit a $3 trillion market valuation. The surge in stock price was fuelled by a favorable U.S. antitrust ruling that allowed Alphabet to retain key assets like Chrome and Android, easing investor concerns.

Indonesia’s ₫16.2 Trillion Stimulus: Indonesia has rolled out a nearly US$1 billion stimulus package kicking off in Q4 2025, to safeguard economic momentum and hit its 5.2% growth target. Measures include food aid, income tax relief for tourism workers, discounts on insurance for motorbike-taxis and truckers, and a “cash-for-work” scheme that will aid over 600,000 people.

UAE-US Deals Raises Conflict-of-Interest Concerns: A recent report reveals that Steve Witkoff, the U.S. Middle East envoy, and UAE’s Sheikh Tahnoon have struck two major deals that critics argue blur official duties and personal financial interests. One deal has UAE investing $2 billion into World Liberty Financial, a crypto startup co-founded by Witkoff and Donald Trump. The second allows the UAE-controlled tech firm G42 to access advanced U.S. computer chips, despite worries the technology could ultimately leak towards China. Ethics experts are calling attention to overlapping interests.

Aur Batao 📰

CCI Raid: India's antitrust watchdog conducted surprise raids on the offices of steel pipe manufacturers Jindal Saw and Maharashtra Seamless near New Delhi. The raids were initiated following a 2023 complaint from state-run ONGC regarding alleged bid rigging in certain tenders. The investigation is ongoing and could take several months.

GST Discounts: The government has instructed retailers to advertise GST discounts on bills and in advertising clearly. This step, ahead of the introduction of a new two-slab GST structure effective from September 22, ensures that consumers benefit from tax reductions on nearly 400 goods during the festive season.

Dehradun cloudburst: A devastating cloudburst struck Dehradun, Uttarakhand, on September 16, 2025. The event caused significant destruction and triggered a major rescue and relief operation by multiple agencies, including the NDRF. There are reports of casualties and missing people.

BJD’s fertiliser protest: The Biju Janata Dal (BJD) staged a protest in Odisha over a fertiliser shortage, especially for urea, which is impacting about 70% of the state's farmers. The demonstration in Bhubaneswar led to a clash with police as workers tried to march to the Governor's house. Both the state government and the opposition have made conflicting claims regarding the availability and distribution of fertilisers.

Betting app probe: The Enforcement Directorate has summoned former Indian cricketers Robin Uthappa and Yuvraj Singh, along with actor Sonu Sood, in a money laundering case linked to the illegal betting app 1xBet. Other celebrities, including Suresh Raina and Shikhar Dhawan, have also been questioned as part of the ongoing probe. The ED is investigating the financial transactions of those who endorsed the app.